EQT Future

Solving Today's Problems, Creating the Winners of Tomorrow's Economy

EQT Future's approach allows us to own companies for longer periods than EQT Equity, fostering the growth of potential market leaders over the long term and potentially transforming entire industries. We leverage EQT’s proven active ownership approach and a tailored impact management and measurement toolbox with the aim to drive attractive, downside-protected returns.

Equity tickets

350M+ EUR

Portfolio companies

5

Investment Advisory Professionals

15

Equity tickets

350M+ EUR

Portfolio companies

5

Investment Advisory Professionals

15

Growing market leaders over the long-term, with the potential to transform industries.

EQT Future is an Article 9 fund and has developed ways to align sustainability with financial returns, including linking carried interest to sustainability targets.

EQT Future sets portfolio-wide sustainability targets for its investments to transform how businesses are operated. The targets are supplemented with tailored impact KPIs for each business, designed to accelerate the positive impact of the company’s products or services. We seek to generate net positive impact in portfolio companies through two pathways:

- identifying and incentivizing a pivot from the existing market offering at the time of investment towards products and services with a measurable positive impact

- scaling existing impactful products and services for greater reach and depth of impact.

EQT Future is supported by EQT’s in-house sustainability and digitization teams, which includes dedicated impact resources, EQT Private Capital’s global sector teams, and EQT’s extensive advisory network. The Future Mission Board, co-chaired by Paul Polman and Jacob Wallenberg, brings a broad spectrum of expert competencies and provides strategic direction with a clear focus on the purpose and impact thesis of each investment.

Spotlight OnFuture

Explore Our Portfolio

See all

A leading global specialist within pest control

The company currently has operations in 18 countries across Europe, Asia-Pacific and the US and serves almost three million customers. The mission is to provide preventive pest control solutions to both companies and consumers. This translates into providing consumers and businesses with "peace of mind' and a pest free indoor environment and safeguarding industries' food production.

Sector

Services

Country

Sweden

Responsible advisor

Per Franzén

Entry

2012

One of the world’s largest premium fruit-breeding companies

With over 30 years of experience, BLOOM uses natural breeding techniques to develop new table grape, raisin, cherry and blueberry varieties for consumers worldwide.

Sector

Food Technology

Country

United Kingdom

Responsible advisor

Simon Griffiths

Entry

2023

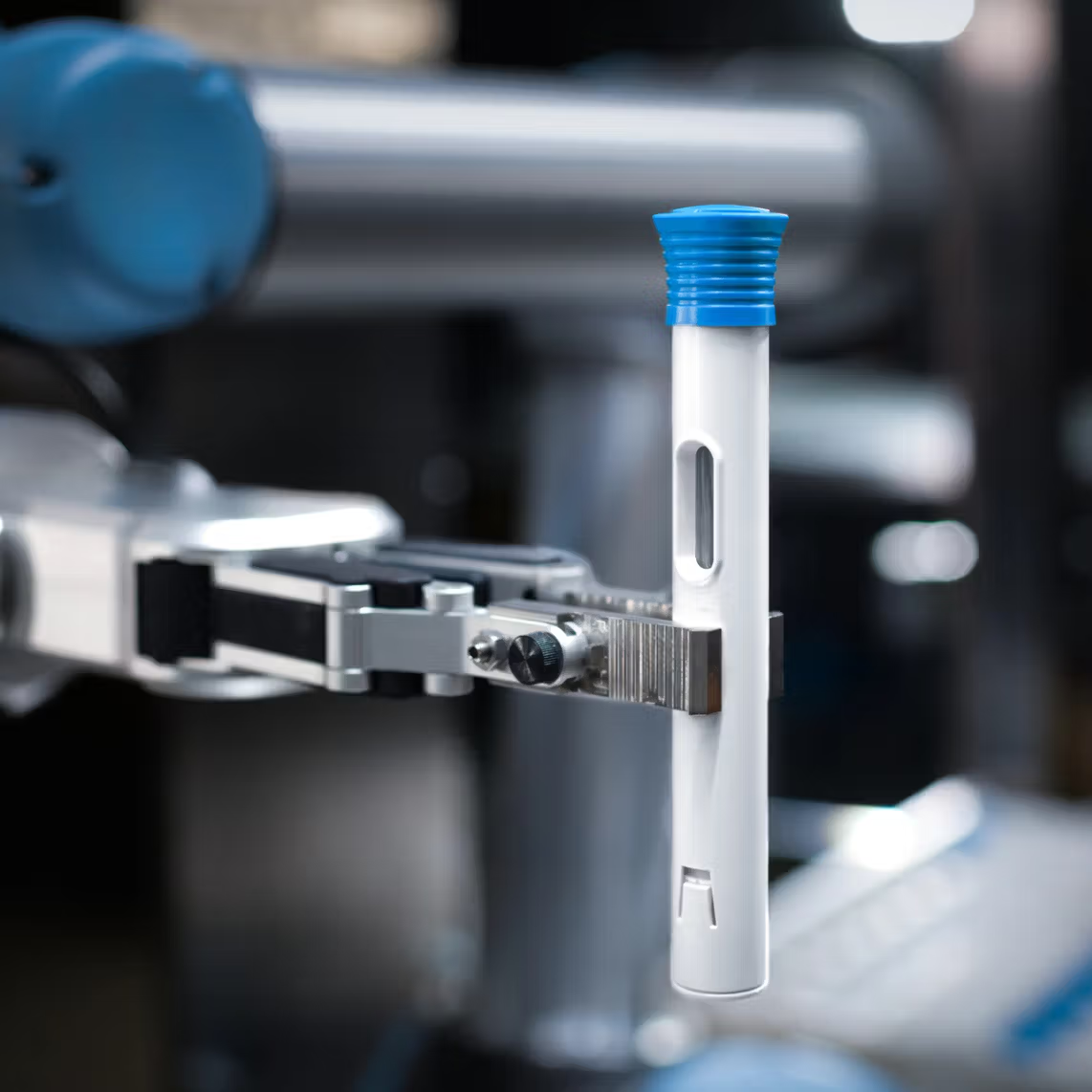

World-leading advanced delivery device

SHL Medical is a leading developer and manufacturer of advanced drug delivery systems such as autoinjectors and partner to global pharma and biotech firms. SHL’s products enable effective and precise delivery of highly complex biologics and biosimilar drugs.

Sector

Healthcare

Country

Switzerland

Responsible advisor

Andreas Aschenbrenner

Entry

2023

Transforming public transport through sustainable & affordable long-distance bus and train travel solutions

With its asset-light business model and innovative technology platform, Flix, launched in 2013, swiftly established market-leading positions for long-distance bus travel in Europe, North America and Türkiye and is rapidly expanding further into South America and India through its brands FlixBus, FlixTrain, Kamil Koç, and Greyhound.

Sector

Transportation

Country

Global

Responsible advisor

Andreas Aschenbrenner

Entry

2024

The EQT Future Team

Simon Griffiths

Partner, Head of EQT Future & Global Head of Industrial Technology, Private Capital

Do You Want to Know More?

We are eager to explore how we can achieve great things together.

Exclusive News and Insights

Press the button below to sign up for our EQT newsletters.