Does the EU Need Its Own Stock Exchange?

As European companies head to the U.S. to seek initial public offerings, EQT’s Magnus Tornling says the EU is moving closer to consolidating its exchanges into a single market.

- Europe’s IPO market is lagging behind the U.S. as startups seek deeper, risk-taking capital pools.

The European Union has a larger population than the U.S. and its people save significantly more, yet in recent years the sums raised on American stock markets have topped those in Europe. As European politicians turn their attention to the conundrum of declining global competitiveness, might it be time for the EU to create a single pan-regional stock exchange?

EU households saved about 15 percent of their disposable income last year, compared with just 8 percent in the U.S., according to data compiled by the European Central Bank. That created some €1.4tn ($1.6tn) that could be invested in European companies. Yet while U.S. households allocate almost half of their total financial assets to equities, in the euro area only a tenth of households’ financial assets are in equities while 33 percent are held in cash and deposits.

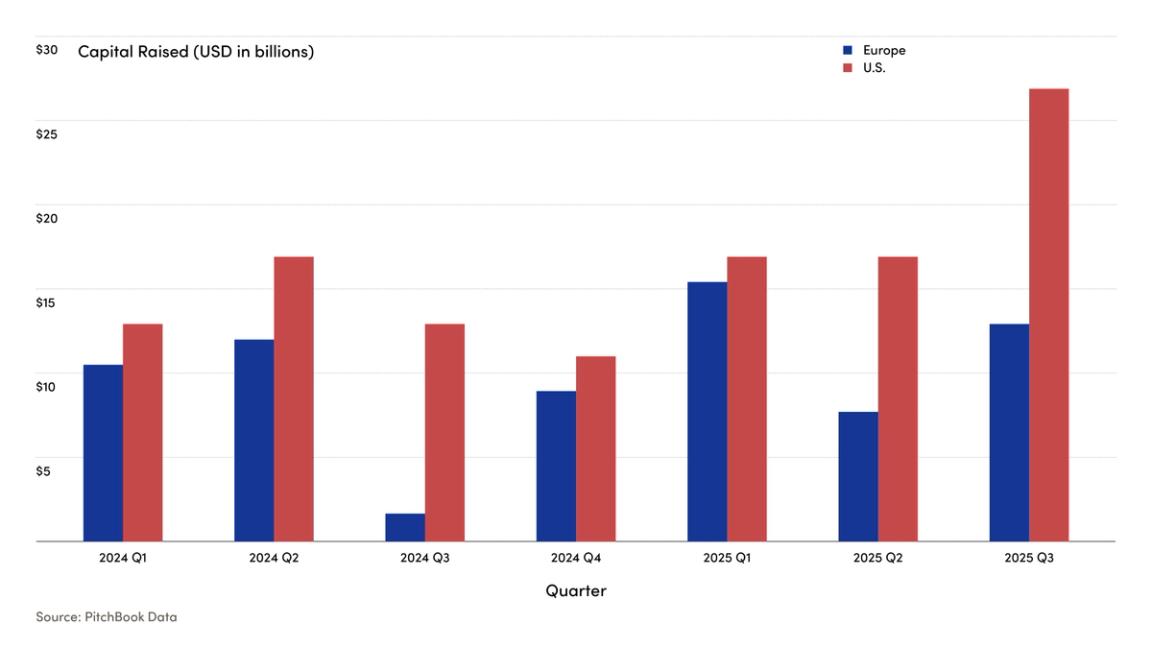

That hoarding of cash has a knock-on effect. Companies raised $36.3bn in initial public offerings on EU exchanges in the first nine months of 2025, compared with $61.6bn on U.S. exchanges, according to Pitchbook data. High-profile European companies including Swedish fintech Klarna have sought IPOs in New York this year, shunning their home markets. The region’s politicians are starting to take note, with German Chancellor Friedrich Merz joining calls for a pan-European exchange to be part of the solution.

Capital raised in IPOs (Source: Pitchbook)

“The amount of trading volume is teeny, teeny tiny versus the Nasdaq,” says Barney Hussey-Yeo, founder and CEO of Cleo, a UK-based startup that provides AI financial assistants and plans to go public in the coming years. “The United States is risk-on, while the UK, Germany, France are very risk-off.”

The Brexit dividend

Before Brexit, London was the key hub for European listings, consistently beating regional rivals in IPO volume and market capitalization and acting as a gateway between Europe and the rest of the world. Post-Brexit attempts to recreate a similar model have yet to succeed. Frankfurt, Paris, Amsterdam and Stockholm have each shown progress, with no single hub consistently coming out on top for listings.

“Each city captured a piece of activity that London once hosted,” Francesco Fulcoli, chief compliance and risk officer at Flagstone, a fintech startup, and an adviser to the European Commission, wrote in an email interview with ThinQ. “But none recreated London’s ‘full stack’ of banking, buy-side depth, legal infrastructure and global connectivity.”

Meanwhile, the U.S. and China have built formidable listing platforms, supported by significant institutional investment positioned toward innovation. Europe needs to mobilize at least €750bn a year to keep pace with global competitors, according to a 2024 report led by former European Central Bank President Mario Draghi.

A unified future

The EU is taking steps to address these challenges. Recent initiatives to unify capital markets, streamline disclosures and promote cross-border listings point to a willingness to consolidate in a bid to spur regional growth. European Commission President Ursula von der Leyen announced a drive to increase support for startups within the region. A pan-European exchange would build on these efforts.

“If it doesn't happen now, it will never happen,” says Magnus Tornling, Global Head of Equity Capital Markets at EQT. “I haven't seen this kind of momentum before.”

A pan-European exchange “needs to be like the New York Stock Exchange or Nasdaq,” Tornling continues. “The same listing requirements regardless if you’re in Sweden or Germany, the same notification rights. In the U.S., it’s completely irrelevant if a company is incorporated in Delaware or Texas when trading. Europe should be the same.”

Integrating European capital markets into one center could help unlock the EU’s estimated €13tn in private savings, according to Euronext, which operates the Paris and Amsterdam exchanges, among others. However, Cleo’s Hussey-Yeo warns that a pan-European exchange is only one part of the puzzle. “You've got to incentivize all of the big pools of capital to invest heavily into these growth stocks,” he says.

Competing specialists

Upending the current EU landscape of fragmented, national exchanges is no small task. Local protectionism stands as one of the highest barriers, with many areas standing to lose employment opportunities should all the exchanges be consolidated into one. “There will be some real pain points,” Tornling says. “If everything was just positive, this would have happened a long time ago.”

Per Franzén, EQT’s CEO, agrees that the EU’s end goal should be a pan-European exchange, while cautioning that national governments shouldn’t delay implementing their own reforms. “Europe cannot afford to wait for such a pan-European stock market to become reality,” Franzén wrote in an open letter in October. “In the meantime, all big European economies should establish national task forces to replicate best practices from member states where capital formation is stronger.”

The EU’s fragmented approach can hold some benefits, notes Fulcoli. Although he supports the drive towards a pan-regional exchange, “competition between venues can sharpen execution quality and compress costs; specialization allows each market to play to its strengths; and resilience improves when no single location is a point of failure,” he writes, labelling the current landscape as “a network of competing specialists rather than a single sovereign node.”

Europe’s fiscal challenge

However, with high-growth startups pouring out of the region as they look to scale, ministers are starting to sense a new urgency. “A lot of the heads of state are really waking up to the fact that if they don't do something they're going to have these spiraling costs with aging populations, with massive welfare bills, with pension costs rising dramatically and low birth rates unless they get economic growth in 20-30 years,” says Hussey-Yeo.

While European ministers have gained a reputation for the slow “risk-off” implementation of such disruptive measures, it is this urgency that Hussey-Yeo believes may have the potential to drive rapid change.

“The choice facing policymakers is clear: double down on integration that lowers friction and deepens pools of capital, or accept a future in which the continent remains a formidable manufacturer of companies and a reliable exporter of listings,” concludes Fulcoli. “The tools exist. What remains is the political will to use them at full scale.”

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofInsights

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.