Can Investors Save America from an Infrastructure Crisis?

One of the biggest threats to U.S. economic competitiveness isn’t external, but internal. An increase in investment is urgently needed to revive aging infrastructure.

- America’s infrastructure is struggling, threatening to erode the country’s economic competitiveness.

From aging highways to crumbling dams, America’s infrastructure backbone is alarmingly fragile. Decades of deterioration and underinvestment are jeopardizing the country’s economic competitiveness and raising concerns about public health and safety.

Despite modest improvements in some areas, an estimated $3.7tn investment gap is leaving the nation’s power grids, roads, bridges, ports, water systems, waste facilities and other assets in an increasingly vulnerable position. Rising energy demand, fueled by the rapid growth of AI data centers, and extreme weather events are adding to the strain.

“We are in a situation where we could start experiencing more frequent major failures because our infrastructure is inadequate and rapidly aging,” says Darren Olson, who chairs the Committee on America’s Infrastructure, which publishes an assessment of the country’s core assets for the American Society of Civil Engineers (ASCE).

While public spending lags, demands on America’s vast infrastructure network are intensifying amid an AI boom, the transition to renewable energy and efforts to expand industrial capacity. Modernizing the country’s infrastructure will depend on significant increases in investment, with private capital playing an important role.

'Mind-Boggling' Crisis

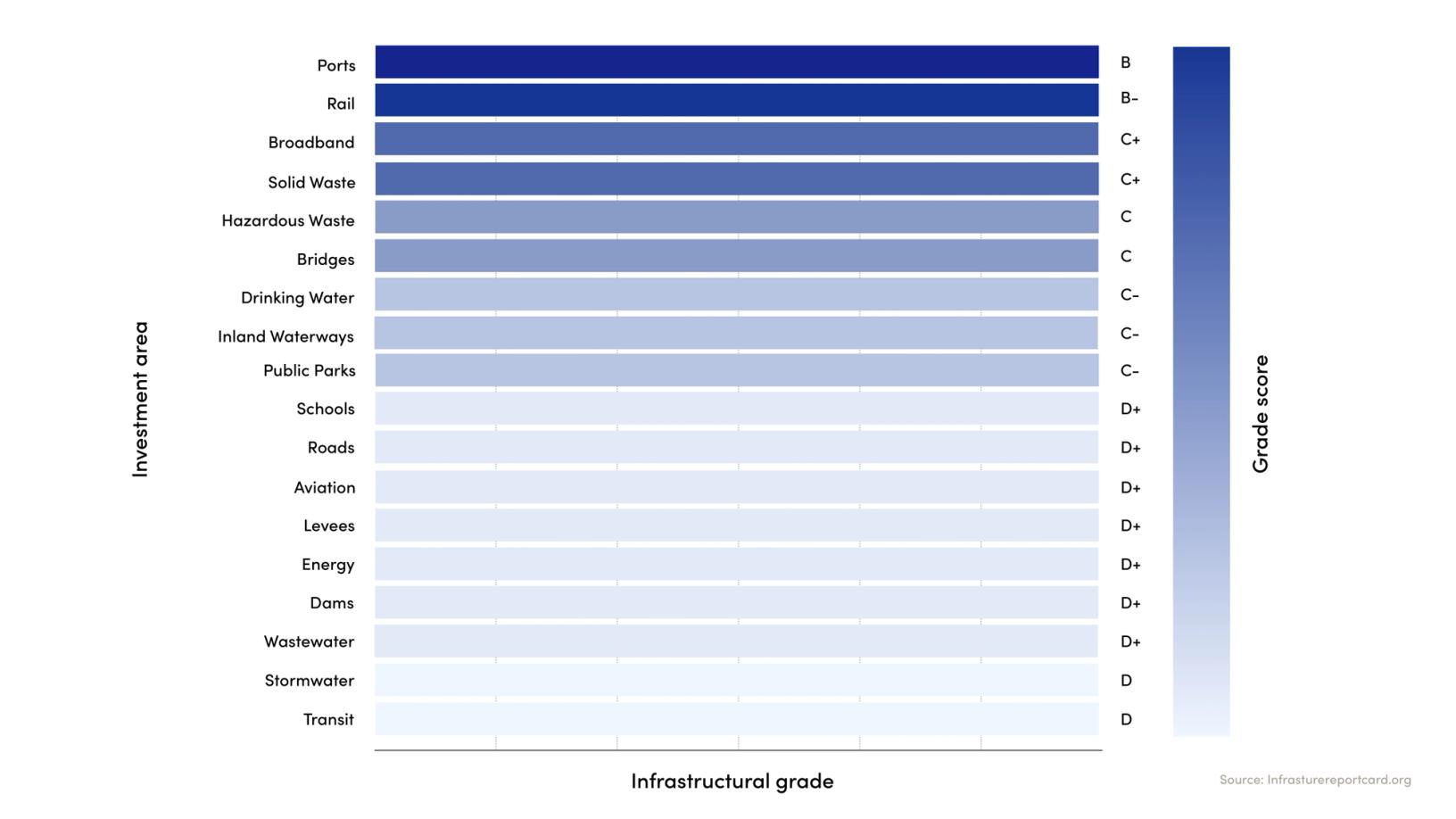

A widely-read report card from Olson’s group, which is published every four years and evaluates the condition and performance of roads, bridges, energy, and aviation, gave the country an overall grade of C, a slight improvement from a C minus in 2021. Olson called the state of American infrastructure a “mind-boggling crisis” that should never have occurred in the world’s biggest economy.

“The last thing we can do right now is be proud of a C grade,” Olson says.

Energy is probably the most concerning category in this year’s report. Increasing demands are straining a grid Olson describes as “archaic” and increasingly unfit for the pace and pressures of modern use, such as integrating green energy. By 2035, Deloitte estimates that power demand from AI data centers in the U.S. may increase more than thirtyfold. While the national energy network, a patchwork of unconnected regional grids, could become a bottleneck for economic growth, it also stands to benefit from the innovation of private equity-backed businesses.

Scale Microgrids, recently acquired through EQT’s new Transition Infrastructure strategy, is among companies helping to boost the resilience of the energy network by providing local municipalities, institutions and large companies with on-site systems that integrate solar and battery storage and other assets. Those systems provide flexibility to a rigid energy system while helping to reduce costs and emissions.

PE is Inevitable

In improving the intersecting network of infrastructure assets, it’s important to understand the history of how America fell behind. The challenges stem from a mix of politics, NIMBYism, funding shortfalls and regulatory hurdles, according to Alex Darden, EQT’s head of infrastructure for the Americas.

Even relatively simple projects must navigate a maze of approvals from city, county, state and federal authorities. Meanwhile, shifting political agendas can abruptly halt a project; a major concern given most infrastructure developments are long-term, he says. While the problem has gained attention, it’s still not taken seriously enough.

“It has been a creeping crisis, and people don’t generally deal with a creeping crisis until it is too late,” he says.

So much capital is required to bring systems up to standard and keep pace with rising demand that private investment will have to play a greater role, alongside government funding. Darden notes that the ASCE report shows that the worst-performing categories are often those maintained primarily by the public sector.

Seeing a significant long-term growth opportunity, private equity firms are steadily ramping up investments to help meet the increasing needs for energy, transport and digital infrastructure. Institutional investors are also showing growing interest, with a recent McKinsey report finding almost half plan to increase infrastructure allocations in 2025.

Furthermore, Preqin predicts that global unlisted infrastructure assets under management will reach $2.4tn in 2029. This momentum is paving the way for niche and emerging managers that are targeting overlooked assets. Colorado-based PERENfra, for instance, recently closed its inaugural $125m fund to invest in water infrastructure projects.

Funding alone is not enough. Long-term progress will require sustained political support. The 2021 Infrastructure Investment and Jobs Act, which aimed to direct $1.2tn over five years toward modernizing transportation, broadband, water systems, and clean energy, was a significant breakthrough, but its rollout has been uneven, with progress slowed in some areas.

Abundance

One emerging policy framework aimed at addressing the crisis is the “abundance agenda,” a movement that originated within the centrist wing of the Democratic Party and is beginning to gain traction across the aisle. Popularized by Ezra Klein and Derek Thompson in their best-selling book, Abundance, the movement urges a shift from scarcity to capacity by removing bureaucratic barriers.

The agenda, championed by politicians such as New York Rep. Ritchie Torres and Gov. Kathy Hochul, calls for a reinvention of how America builds, emphasizing the need for urgency, scale and investment to address decades of sluggishness.

Olson believes there is enough time to reverse the decline. With growing investor interest, a push to reduce regulatory red tape and, most crucially, a major increase in spending, he argues that the crisis can still be averted, especially with the help of private markets.

Ultimately, there is a broad consensus that American infrastructure urgently needs attention. As former President Ronald Reagan warned in a 1982 radio address, “the bridges and highways we fail to repair today will have to be rebuilt tomorrow at many times the cost.”

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofInsights

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.