Understanding ELTIFs: How Recent Regulatory Changes Affect Private Wealth Investors

The European Union’s ELTIF framework enables individual investors to participate in sectors once reserved for institutions. But what exactly is an ELTIF?

- ELTIFs are regulated funds designed to provide long-term capital to European businesses and projects, with recent reforms making them more accessible to individual investors.

A European long-term investment fund (ELTIF) is a regulated investment vehicle that enables investors to back companies requiring long-term, patient capital. ELTIFs are designed for investment in infrastructure projects, real estate and small and medium-sized enterprises. The European Union updated the regulations governing these funds after a lukewarm initial reception.

The EU adopted the initial ELTIF framework in 2015 and the original ELTIFs were exclusively structured as traditional closed-end investment vehicles with a fixed life span (often 8 to 12 years). The regulation also stipulated that at least 70 percent of an ELTIF be invested in long-term eligible investment holdings, while the rest could be in cash or liquid securities for flexibility. To limit concentration risk, exposure to a single company or project was capped at 20 percent of the portfolio. And where ELTIFs were made available to individual investors, borrowing was limited to 50 percent of net asset value, with a minimum investment threshold of €10,000 ($11,700).

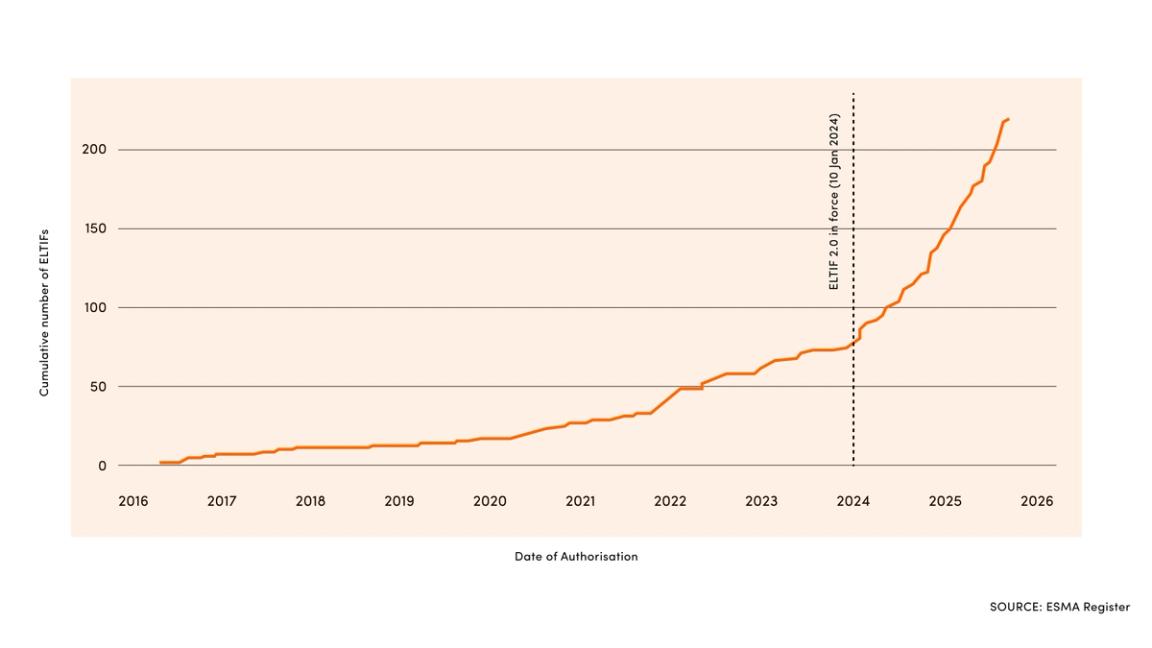

However, by October 2021, only 57 ELTIFs had been launched over six years, with total assets under management standing at just €2.4bn. No EU states outside of Luxembourg, France, Italy and Spain had launched domestic ELTIFs.

ELTIF 2.0

To boost these numbers, the EU tweaked the rules in 2024, broadening the number of eligible assets within ELTIFs, increasing the number of structuring options, and removing the minimum investment amount (although some national regulators may still impose their own thresholds). In 2024 alone, 55 ELTIFs were launched under the new ELTIF 2.0 framework.

“While the initial ELTIF 2.0 framework created initial momentum and there were early movers in 2024, prescriptive liquidity management guidelines meant that in practice it was challenging for leading GPs, including EQT, to take existing evergreen flagship strategies and offer them in an ELTIF format without significantly compromising on either returns or liquidity features,” says Philip Heeroma, a Director in EQT’s Client Relations team. “As a result, the industry's leading GPs sat on the sidelines until the liquidity guidelines were further clarified by ESMA, helping make ELTIFs more compatible with the deployment styles of leading GPs and attractive as evergreen offerings.”

To make ELTIFs work more like other private market funds, the new rules also relaxed diversification and borrowing limits and introduced more flexibility around liquidity and redemption features. Investors can access periodic redemption opportunities, when they can sell some of their holdings.

Cumulative Authorised ELTIFs in the ESMA Register

One of the most significant benefits of the ELTIF framework is that it allows individual investors to access private equity, infrastructure and other similar asset classes that regulators previously reserved for institutional investors. This provides individual investors with an opportunity for diversification. It gives exposure to unlisted and long-duration assets, which do not necessarily rise or fall in line with broader market cycles. ELTIFs also aim to mobilize long-term savings toward productive investments that contribute to economic growth, job creation and sustainability.

Especially in funds with redemption features or an evergreen design, investors may get partial exit opportunities much sooner than usual commitment periods, which can last a decade or longer.

Potential risks and complexities of an ELTIF

However, ELTIFs remain a complex financial product. The German Federal Financial Supervisory Authority (BaFin), for example, sets rules for Germany and requires stringent liquidity and redemption safeguards for ELTIFs. Meanwhile the European Securities and Markets Authority (ESMA) sets EU-wide standards such as minimum notice periods, redemption frequency limits and caps on liquid redemptions to protect investors.

In addition, the fee structures of ELTIFs can vary and are often different from the standard flat management fee typical of more mainstream investment products, such as exchange-traded funds (ETFs). These may include a management fee (a fixed fee that goes to the entity managing the investments), a servicing fee (which goes to fund distributors, such as wealth management firms, to cover advisory or administrative services) and carried interest (a performance-linked share of the profits, usually only paid if the fund achieves returns above a certain hurdle rate). Unlike with ETFs, ELTIFs’ fees are structured to reward long-term performance – as with a classic private equity fund. In practice, this means an ELTIF’s fee can vary depending on the performance of the underlying assets.

Despite these complexities, with clearer EU rules and supportive national initiatives, such as Italy’s tax incentives and France’s integration of ELTIFs into insurance products, ELTIFs may yet have further to grow. According to a PwC report from August 2025, market participants expect the segment to triple by 2027 as the framework becomes a more mainstream way for individual investors to gain exposure to private markets.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofEducation

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.