How Private Capital Firms Make Money: Fees and Carried Interest Explained

In private capital, how firms get paid includes two key components: management fees and carried interest. This article unpacks how these work, how they align investors’ and firms’ incentives, and the approach at EQT.

- Private capital firm earnings are built around management fees and performance-based carried interest.

Private capital firms are known for ambitious deals and long-term investment strategies that, when successful, can deliver significant returns for those who invest in the funds. But how do the firms behind these funds make money?

Whether you’re considering a career in private markets or simply curious about the business model, understanding how such firms and investors make an income helps explain how the industry is incentivized to increase the value of portfolio companies.

In this article, we’ll explore how firms generate revenue, focusing on two key components: management fees and carried interest.

What are private capital management fees?

Management fees are the most visible long term revenue stream. Typically calculated on a percentage of a fund’s committed capital – usually around 2 percent per year – this income stream is used to help , cover operational costs.

The "2 and 20" model – 2 percent annual management fee and 20 percent carried interest (more on that later) – has been a standard in the industry for decades. For example, a firm overseeing $10bn in committed capital, charging a 2 percent management fee, would earn $200m annually in management fees.

This fee model has its roots in hedge funds from the mid-20th century and it remains widely used for its simplicity.

It’s important to underline that management fees are not tied to investment performance. This makes them a stable source of income for firms, particularly in the early years of a fund before exits begin to generate returns.

The sums of money on which management fees are calculated evolve over a fund’s lifecycle, decreasing during the later years as active investment winds down and portfolio management becomes the focus.

At EQT, for example, management fees follow a lifecycle-based approach. During a fund’s early, active investment phase – known as the commitment period – management fees are typically based on committed capital. As more of the capital is invested and the fund evolves, it enters the post-commitment period. Management fees are then calculated on the amount of capital invested, and naturally decline as investments are exited over time.

What is carried interest?

While management fees keep the lights on, carried interest – often simply referred to as “carry” – benefits firms for creating value through active ownership of portfolio companies.

Carried interest is a share of the fund’s profits, typically 20 percent, that goes to the carried interest recipients – but only after the investors have received their preferred return or ‘hurdle rate’. This is the minimum annual return LPs must receive on their invested capital, and it usually sits at around 8 percent. Simply put, it’s a performance benchmark – a ‘hurdle’ private capital firms must clear before they can start collecting their own share of the profits.

Carry is designed to align the interests of the firm with its investors: there are no meaningful profits for the carried interest recipients unless the fund performs. However, carry also introduces a delay – it is usually only distributed after successful exits, which can take several years. This underlines the importance of management fees in funding operations.

Overall, a typical structure will see 80 percent of profits go to LPs and 20 percent to carried interest recipients, with the carried interest recipients often being the key contributors and the firm itself. How the carry is split among participants will vary between private markets firms. Some choose only to let partners and senior deal team members participate, while others will have a wider circuit of carried interest recipients.

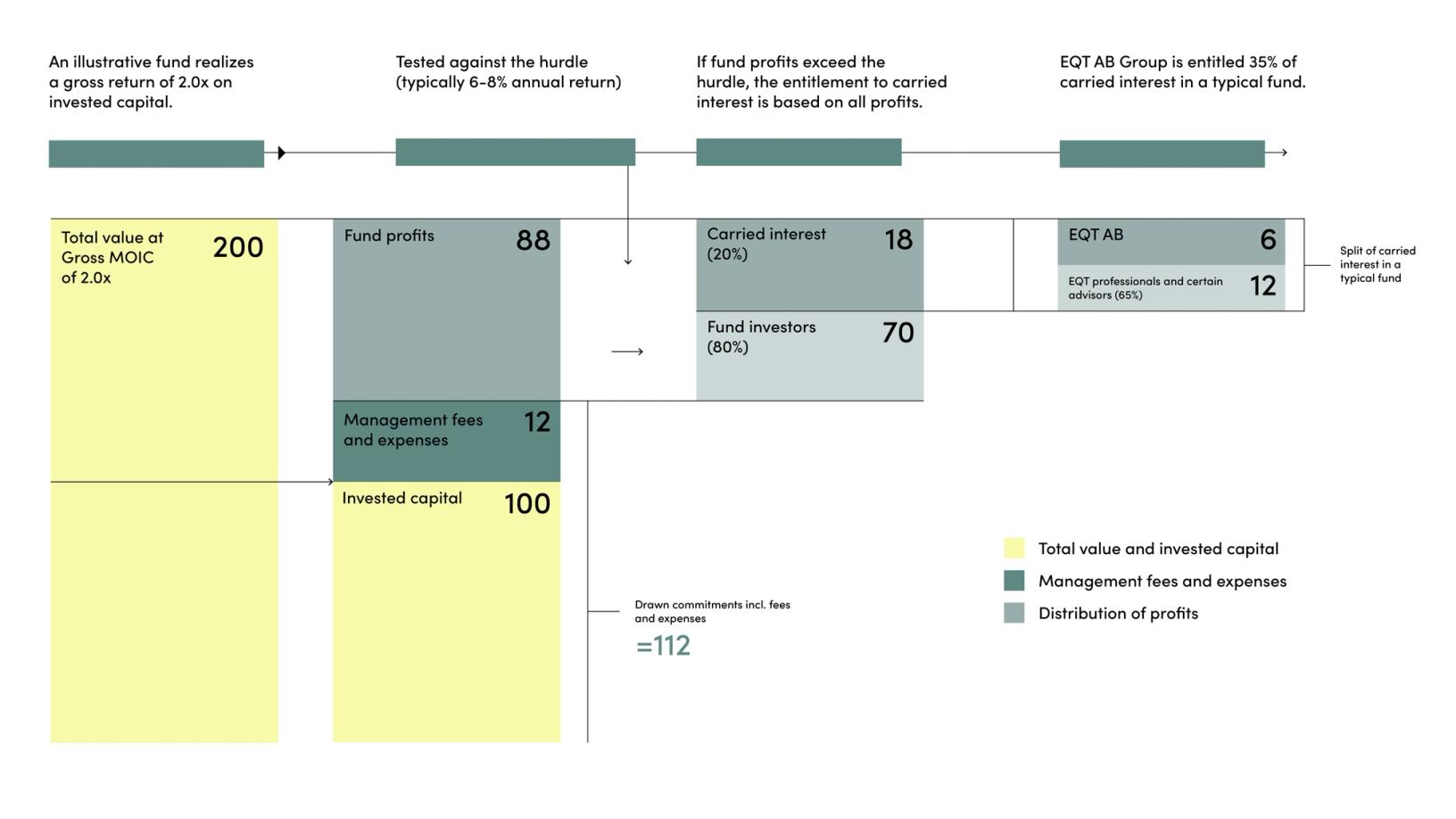

At EQT, carried interest is only distributed when a fund delivers strong returns, typically above a 6-8 percent annual hurdle rate. Once that requirement is met, profits are usually split 80/20 between fund investors and carry recipients. As the graphic below shows, the amount of carry allocated is entirely based on the fund’s performance.

Source: EQT. For illustrative purposes only

Understanding how compensation works at private markets firms is key to grasping how the industry functions – and why performance alignment matters. Management fees provide stability, while carried interest ties the monetary benefits of the firm to those of its investors. Together, this combination of fixed fees and performance-based return underpins the industry’s operational discipline and outcomes-focused culture.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]