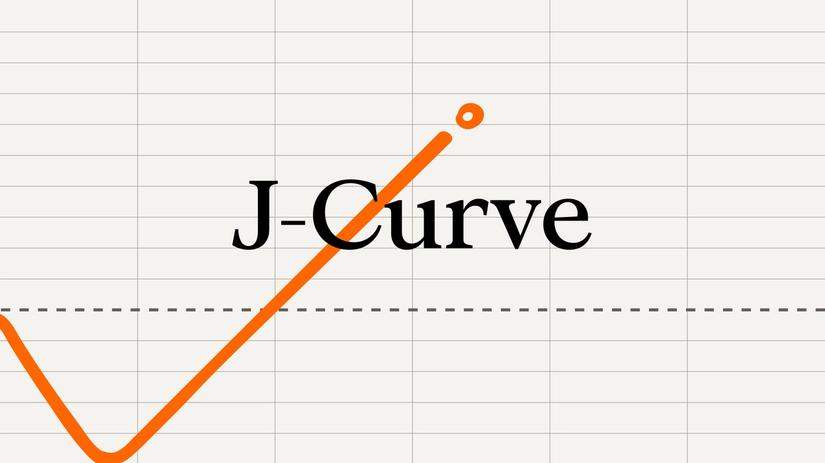

What Is a J-curve?

What a J-curve could teach you about investing

- A J-curve is a term used in economics and investing to describe a trendline on a chart, which shows a temporary decline in value before an immediate surge to above its original level.

- It is often used to refer to the typical trajectory of an investment in another company made by a private equity firm.

A J-curve is a trendline on a chart that shows the value of an investment declining temporarily before a rapid surge to above its original level. While the term is widely used in economic circles, it is often used to describe the potential trajectory of a private equity investment.

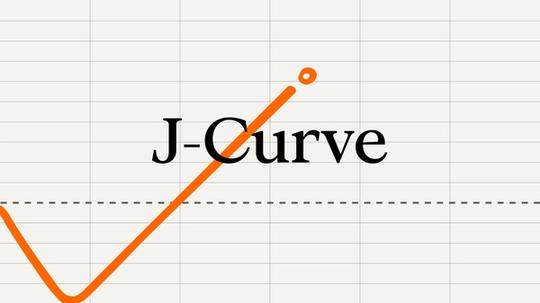

Commonly, private equity firms will aim to acquire companies to make operational improvements that drive growth and profitability. The value of that investment will often dip at first, pushing the initial investment into the red. The reduction in value is sometimes temporary due to high upfront costs, management fees and early-stage investments that have yet to mature or generate returns. Additionally, new investments may underperform or require time to gain value.

After some time, as investments mature and if operational improvements begin to bear fruit, the performance of the acquired company may begin to improve, which can lead to a large uptick in its valuation. A steep bounce in value above the initial investment level would enable the private equity firm to sell the company for a profit in the future.

Understanding the J-curve is important for private equity investors because it demonstrates that investments often take years to generate significant profits – if at all. They allow investors to set realistic expectations for how and when returns may materialize, emphasizing the importance of a long-term commitment. Investors must be prepared for early losses of limited returns during the early stages of their investment, and the J-curve highlights the need for patience and strategic planning to achieve desired returns.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]