Five Things Every New Board Member Should Know

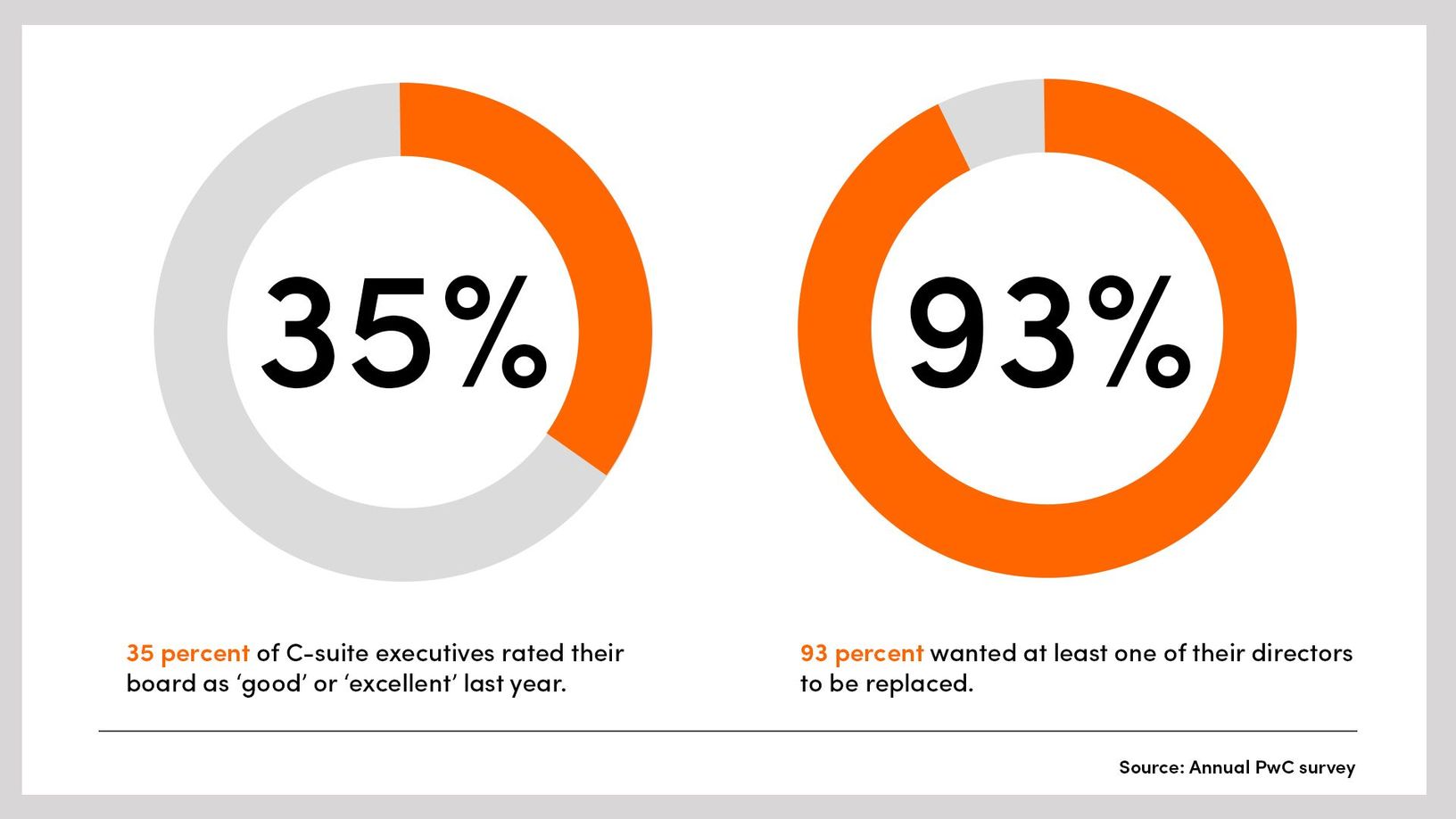

Only 35 percent of top executives rate their board as ‘good’ or ‘excellent.’ Here’s how to add value from day one as a new board member.

- First board meetings are a reality check. Listen, observe and understand what the business really needs.

Walking into a boardroom for the first time can be daunting. Only 35 percent of C-suite executives rated their board as ‘good’ or ‘excellent’ last year, and 93 percent wanted at least one of their directors to be replaced, according to an annual PwC survey.

Those who get it right, however, play an invaluable role. The best board members help guide long-term strategy, create shareholder value and serve as true partners to the management team. They become trusted first calls for founders, ask sharp questions and never stop learning. Whether you’re joining your first board as an investor or non-executive director, here’s what to expect and how to add value from day one.

Below are five things new board members should consider - the first in a series of ThinQ articles addressing common business challenges and how readers can prepare for them.

Prepare for a reality check

“The first board meeting is always a bit of a reality check, because suddenly you really understand what’s happening in the business,” says Naza Metghalchi, a Principal at EQT Ventures who works with founders in sectors including B2B software and enterprise AI.

This is particularly true for investors, as no matter how thorough the due diligence, fundraising is ultimately a sales exercise, where founders present their best case. However well you know the CEO and company from the outside, the first meeting reveals the CEO and management team’s true capabilities and where the biggest challenges lie. Treat it as an opportunity to better understand how the business actually works.

Do your homework

The quality of preparation defines the quality of the conversation. Before the first meeting, revisit materials from the investment process. Research the company’s history, strategy and challenges. Review past board packs and minutes to see how founders run their meetings. Ideally, materials should be shared in a collaborative format, such as Google Docs, so that simple questions can be answered ahead of time. “You’re also seeing how other board members react to the information and what matters to them,” Metghalchi says.

An effective meeting devotes one-third of the time to reviewing performance, including the CEO’s quarterly summary and key updates. The rest of the conversation should focus on two or three big strategic decisions the CEO wants to discuss, such as fundraising plans, expansion, C-suite hiring and so on. The average board meeting for a £100m+ turnover business now runs for 3 hours and 48 minutes, with each agenda item receiving just 21 minutes of discussion, according to Board Intelligence. That’s barely enough time to scratch the surface. So, make sure you keep the conversation focused and on track.

Finally, speak with other board members in advance. “That’s a really good opportunity for you to assess the quality of the company,” Metghalchi says. “How do they answer your questions? Are they really deep into this business, or are they just passengers?”

Start by listening

Resist the urge to jump in with advice immediately. Use the first meeting to observe how the CEO runs the meeting and interacts with the board members. Do the board members actively challenge the CEO or remain passive?

By listening, you can understand the personalities, preferences and working styles around the table. This will help you ask the right questions and be a good sounding board for the hardest decisions. “You’re there to listen and ask the best questions that enable the team to get to the answers,” Metghalchi says. “It’s not about airtime.”

The most effective board members don’t speak the most or show off their expertise. They listen, ask tough questions and help create a space where the CEO can be honest and everyone can focus on the few big strategic decisions that need to be made.

Build trust early

“A lot of CEOs think it’s theatrics,” Metghalchi says. They treat the meeting as an update and want to gloss over setbacks. “But the most productive board meetings are those where you have a really good discussion around specific topics, and it doesn’t feel like a one-to-many conversation, but everyone is discussing something.”

If the board doesn’t have a clear picture, it can’t offer meaningful guidance. And if CEOs don’t feel they can be candid, they’re less likely to ask for support. Little surprise, then, that 60 percent of U.S. directors are prioritizing candor in board-management discussions, according to the National Association of Corporate Directors.

The most effective boards are partnerships built on trust. “One way that I do it is just being vulnerable,” Metghalchi says. “If you’re vulnerable with someone, that person has a higher chance of being vulnerable with you.”

Make it clear you are there to support and challenge, not to judge. Share personal experiences and be honest about what you don’t know. That creates space for the CEO to do the same. That’s when real conversations happen – about what’s hard, what’s unclear and what needs to change.

Stay out of the weeds

The share of executives who think their board oversteps its oversight role doubled to 32 percent last year from 16 percent the previous year. Board members aren’t there to dictate and micromanage; instead, their responsibility is to act as experienced advisers and provide high-level strategic support. Don’t stray into execution and get bogged down in the minute, day-to-day details. CEOs and their teams are in the weeds every day; the board is there to help them keep the big picture and long-term goals in focus.

As tempting as it might be, don’t jump straight to solutions. Instead, step back and ask more questions. What problems are we trying to solve as a board? How critical is the issue to company success? What are the different options we can consider?

The expectations of CEOs and their management teams are higher than ever before. However, with a savvy approach – starting on day one – you can earn their trust and make a significant impact, helping to mitigate risks and seize the opportunities that lie ahead.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofEducation

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.