Our health economics investment strategy

Backing innovation with direct impact on patients whilst reducing the cost of care

Today’s level of healthcare spending is already putting our historical cure and care system under severe pressure. In the coming decades, a growing and rapidly aging population is expected to add more stress to the system. However, human ingenuity and global innovation has a great potential to develop better prevention, diagnosis and treatment of new and old diseases.

Our Health Economics investment strategy is centred on supporting best-in-class, and first-in-class innovative solutions that simultaneously enhance patient outcomes and drive cost efficiencies across healthcare systems. By focusing on innovative technologies that are already in the market or nearing regulatory approval, we aim to back ventures with de-risked pathways to scale.

Investment Approach

EQT Health Economics supports companies developing and commercialising medical devices, diagnostics, and digital health across Europe and North America.

EQT Health Economics supports companies developing and commercialising medical devices, diagnostics, and digital health across Europe and North America.

Our approach addresses significant unmet medical needs in common diseases to support positive outcomes for patients and that enhance the sustainability of healthcare systems.

The Health Economics strategy is led by a seasoned team with extensive experience and deep expertise in science, industry, and investment, and a track record of pioneering investments in products that enhance care quality while reducing healthcare costs. Each investment that we make includes a detailed and quantitative health care analysis supporting the positive cost impact that introduction of the product or service will make.

Immediate impact on patients and society

Our strategy focuses on supporting high-impact health technologies that improve patient care and reduce system-wide costs.

The innovations in the Health Economic Funds are selected for their potential to scale and deliver meaningful clinical and economic value, in large markets with significant unmet clinical needs. The team brings experience in health tech and health economics, ensuring that each solution addresses real-world needs and supports cost savings and system efficiency for patients and healthcare providers.

With a track record within this investment strategy going back over 10 years, we have invested in more than 25 companies, developing experience and expertise that positions us to excel in this attractive market. Due to the technology sector focus and the stage of company development that we target, we can make an immediate impact. The majority of the companies that we have backed have products on the market today, already improving patient care and driving costs out of the healthcare systems.

Featured Companies within

Health Economics

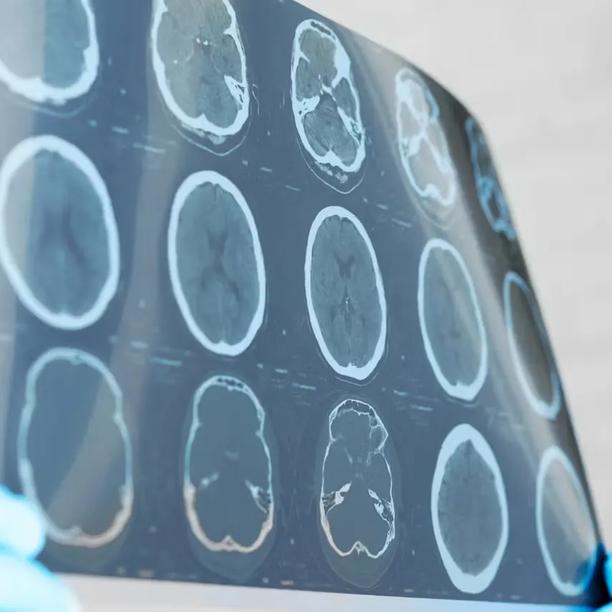

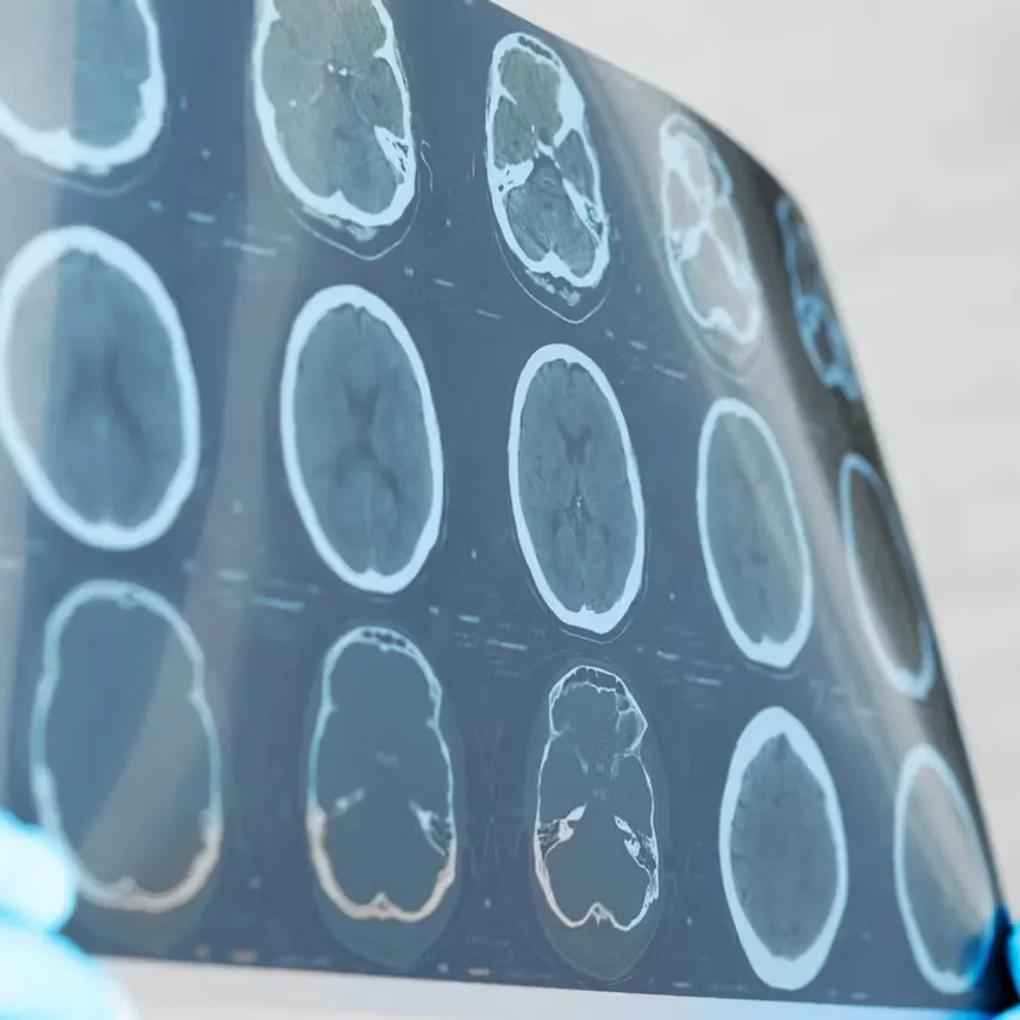

Neuravi

Neuravi, founded in 2009, has developed an innovative stroke treatment that significantly enhances patient outcomes by preserving abilities and saving lives.

The company’s flagship device, the EmboTrap, is specifically designed to efficiently remove clots from the brain — the primary cause of strokes — thereby facilitating recovery. In 2017 and just two years after receiving its initial investment by EQT Life Sciences, Neuravi was acquired by Johnson & Johnson. Today, EmboTrap devices are widely used to treat patients in both Europe and the United States.

Sector

Life Sciences

Country

Ireland

Fund

LSP 5, LSP HEF 1

Entry

2015

Exit

2017

Onera Health

Onera Health is a Medtech/Digital Health company that has reimagined how sleep diagnosis can be performed. Current standard of care (a test called polysomnography or PSG), is expensive (it requires people, buildings and equipment), is inconvenient (it requires the patient to be assessed in a sleep clinic), and it has excessive waiting times that can be months or even years depending on where you live.

Based in the Netherlands, Onera has created a self applied, easy to use and wireless solution that generates the same quality and reliability of information as the standard of care, but from the comfort of the patient's own home. Faster access to sleep assessment allows patients to gain a diagnosis, and receive treatment much more quickly and in a more cost effective way.

Sector

Life Sciences

Country

Netherlands

Entry

2024

Website

Nobi

Nobi is a smart-care solution that looks like a familiar ceiling light, but it is purpose-built for redefining elderly care. The system integrates two-way communication and AI-powered ambient sensors into the lighting fixture. The smart lamp detects every fall in real time, instantaneously alerts caregivers and allows developing deep insights into fall patterns. As a result, help is provided within minutes, long lies on the floor (a major cause of hospitalisations) are eliminated and more than 50% of falls can be prevented1).

Nobi also empowers care-home operators with actionable insights way beyond fall detection. The goal is to enable a shift to proactive more personalised care and allowing care providers to spend more valuable time with the elderly. Nobi's key markets are the US and the UK, but the product is also available in several EU countries, Singapore and Australia.

Sector

Life Sciences

Country

Belgium

Fund

LSP HEF 2, LSP Dementia Fund

Entry

2022

Website

Endotronix

Endotronix, founded in 2007, has developed an innovative digital health and medical device platform that transforms the management of heart failure by enabling proactive and personalized care.

The company’s flagship product, the Cordella™ Heart Failure System, combines a cloud-based patient management platform with an implantable pulmonary artery pressure sensor. This technology allows clinicians to remotely monitor patients and intervene early, designed to reduce hospitalizations and improve quality of life.

Headquartered in Naperville, Illinois (USA), Endotronix has advanced heart failure care from reactive treatment to continuous, data-driven management. In 2024, the company was acquired by Edwards Lifesciences, following the FDA premarket approval (PMA) of the Cordella PA Sensor in June 2024 — a milestone that positions the technology for broad commercial adoption in both the United States and Europe.

Sector

Life Sciences

Country

United States

Fund

LSP HEF 2

Entry

2018

Exit

2024

Website

News

Discover Our Work in Life Sciences

Learn more about our approach to collaboration and innovation in life sciences.

Exclusive News and Insights Every Week

Add your email address below to sign up for our EQT newsletters.