Why AI Value Won’t Just Accrue to Foundational Models

Despite headline-grabbing valuations for AI startups, incumbents that already own market distribution and deep proprietary data could yet capture the lion’s share of AI-driven value.

- While AI model builders are raising money at huge valuations, over time value may spread to incumbents who already control market distribution and proprietary data.

The valuations of many companies at the heart of the AI wave are extraordinary.

In August, OpenAI raised $8.3bn at a $300bn valuation – including money from private equity players Blackstone and TPG for the first time – then sold secondary shares at a reported $500bn mark a month later. Anthropic’s latest round valued it at $183bn. AI search startup Perplexity, barely two years old, is raising at $20bn. France’s Mistral recently raised at a €11.7bn ($13.8bn) valuation.

Such prices suggest that the market has decided, at least for now, that much of the value from AI will go to model providers and startups, rather than established businesses that are busy integrating AI into their processes.

Yet, in time, the AI premium may also net out to incumbents who already own market distribution and deep proprietary data, according to Ethan Waxman, a partner in EQT’s U.S. Private Equity team. “I’m not sure the market fully appreciates the degree to which some enterprise companies can leverage AI for massive efficiency,” he says, adding that they will look to deploy commoditized AI to expand markets and strengthen margins.

Value in mundane applications

Powerful and important as the potential technical breakthroughs of new models are, Waxman suggests “there’s an exuberance around the foundational models, which I would argue probably exists because it's novel. Which isn’t to say there won’t be huge [AI model] businesses.” He explains that the market underestimates the latent value in more mundane applications, which will continue to be built on these models and improve as the underlying technology advances. “Over time the hype around the foundational models will probably subside and they’re likely to become commoditized. It’s likely to get to a convergence point where all the models are good enough for most standard business applications.”

EV/Revenue multiple of selected AI companies, as of July 2025

Even the model-makers are tacitly acknowledging this. To maintain a competitive advantage, they’re becoming as much product companies for developers as they are creators of models. Unless future iterations deliver a step-change in capability, some commentators suggest that models from OpenAI, Anthropic, or Elon Musk’s xAI do not have much of a moat. Many business applications (when fine-tuned on proprietary data) do not need the most advanced or specialist version of each provider, EQT Director Andrew Lewis explains.

“More commonly [our portfolio companies] are using either open source or just very cheap models because the volume that we process tends to be very high,” Lewis says. Older models are already commoditized or in many cases are already matched by open-source alternatives, while small language models (bespoke models that businesses adapt to their specific needs) are cheaper to run and easier to tailor.

Some industry observers are unsure that model providers and startups will retain margins even as usage scales. While some predicted that AI costs would drop quickly and a negative gross margin could be rectified once people were hooked on the models, this isn’t quite playing out yet. GPT-5, OpenAI’s latest model, costs $10 per million output tokens – a similar price point to GPT-4o when it was released in 2024. One report from The Information suggests that assessing true profitability is further complicated by the way some startups report margins, which may exclude the costs of running models for free or non-paying users.

Efficiency’s value opportunity

Over time, “the value is likely to accrue to the application layer and the product companies,” suggests Lewis. That would mean a potentially bigger opportunity for value creation will come from established enterprise companies with pre-existing structural advantages that can integrate AI into operations.

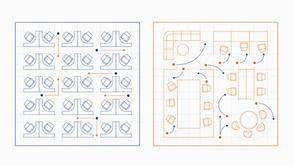

Those with pre-existing contracts, proprietary data or physical infrastructure are likely to be best positioned to capture efficiency gains. For example, Waystar, an EQT portfolio company that processes hospital insurance claims in the U.S., has a competitive moat built from entrenched payer integrations and regulatory hurdles.

In manufacturing, too, established businesses benefit from decades of process data and physical assets. Lewis points out that in these markets there are “a lot of very unique dynamics you have to solve for in order to embed into the product, that aren't necessarily obvious to new disruptive companies.” For businesses that are highly differentiated in less competitive sectors – such as medical devices, capital-intensive manufacturing, highly verticalized IT solutions – AI will amplify incumbency. In industries with lower competitive intensity, efficiency gains are retained as margin, not surrendered in pricing cuts to defend market share.

Expanding markets

AI can also expand the size of markets in ways that can go underappreciated. Software companies embedding AI into workflows can better compete with adjacent services once handled by business process outsourcing (BPO) firms. For Waystar, for example, automating insurance appeals could open up additional use cases and has the potential to increase its Total Addressable Market (TAM) to $20bn by 2027. This untapped TAM expansion, quietly swallowing service layers into software, is further enabled and accelerated by AI. Capturing these deeper, workflow-embedded opportunities may ultimately prove more enduring than competing in the rapid cycle of AI-native product releases, especially in a market where software functionality can be replicated quickly.

To date, some of the biggest windfalls from AI outside the model providers have gone to Nvidia, a chipmaker whose valuation has more than tripled in just two years, to incumbents like Palantir, whose defense contracts give it a structural moat, and to Oracle, which benefits from the data center boom. By contrast, the market has been much more wary of horizontal software-as-a-service (SaaS) firms that promote AI features but lack defensibility: shares of Asana, HubSpot, Atlassian, Salesforce and Adobe have all declined by more than 20 percent this year.

As Waxman puts it: “Never has it been more important to own the market leader with entrenched defensibility.”

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofTechnology

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.