Where Does AI Leave SaaS Business Models?

AI agents threaten the seat-based model that made SaaS so profitable. EQT technology specialist Chris Litchford, founders, and VCs explain how valuations, pricing and moats for SaaS are shifting.

- AI agents can complete tasks directly, potentially undercutting per-seat SaaS pricing.

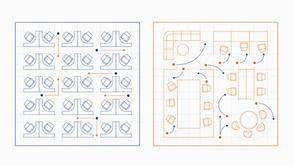

For two decades, SaaS has thrived on a simple formula: sell software-as-a-service by the seat, charge a monthly subscription fee and watch as revenue grows as customers hire more workers. That formula is under attack as artificial intelligence agents from OpenAI, Meta, Alphabet and others promise to drive productivity improvements, meaning fewer workers are needed. Agents might even do the work directly themselves, no software or human seat required.

This poses a potentially big problem for the industry and technology investors. If an agent can draft a contract, run a simulation or generate a sales lead without ever logging into a software product, why should companies keep paying for expensive seats? The per-user model that helped turn Salesforce, Bloomberg and Adobe into giants looks increasingly mismatched with how software is being consumed. The consultants at Bain & Co say disruption of the field is inevitable, though they are uncertain how far it will go.

Entrepreneurs who’ve built SaaS platforms see the same risk from the inside, such as Christoph Gugelmann, who built and recently exited the fintech platform Tradeteq. “In certain areas it will be devastating,” he says. “I think a lot of these bespoke SaaS applications… will not be as attractive anymore.” By contrast, he says, new agentic tools make it far easier to spin up just what a business needs. “You can go on Airtable and build a little CRM tool in 10 minutes [with agents]. It is probably very likely that it can do exactly what you want.”

“The old classical world will probably come under pressure from the new agentic world, and some of them will try to re-engineer themselves. Salesforce is building this massive hub and putting all these agents on top, but there will be a shift… You can just put an agent in the middle and they will do it much faster, much cheaper and with very little building.”

Software vendors are already scrambling to test alternative pricing models that are suited to AI and agents, and allow businesses to run smaller experiments within the traditional environment of a per-seat pricing model. Slack now sells AI features as an add-on for existing seats. Microsoft-owned coding platform GitHub and AI workspace company Notion have taken the same approach. Others, such as the text-to-speech generator ElevenLabs, used by call centers and content creators, use a credit system equivalent to the computing time, whether or not the work is done by a person or a bot. That’s similar to other AI tools such as OpenAI, Anthropic’s Claude or Manus AI, which have token-based payment systems in addition to “per seat” pricing.

Private equity interest

Private equity investors are watching the developments in the industry closely. Chris Litchford, partner and technology sector specialist at EQT says these pricing debates matter less for valuations than readiness for AI itself. “AI is a very real, very credible threat to the traditional software ecosystem,” he says. “But I don’t think seat-based pricing is going away overnight. What I think you’re going to see is an evolution to more hybrid pricing models that incorporate some baseline level of access [with] value- or consumption-based add-on capabilities,” he says, referring to the models used by GitHub and Slack.

What matters more in the AI age, argues Litchford, are moats, or the things that are hardest for rivals to copy, which can create a defensive advantage in a market where AI removes other barriers. “There are a variety of characteristics that can enhance your ability to adapt and defend against AI capabilities. Things like market leadership and depth of customer relationships, scale advantages driving higher awareness, long-tenured customer relationships that are broad and deep, and access to robust, longitudinal first-party data. Those are the types of potential moats that we’re looking for from a defensive perspective,” he says. But even strong incumbents need to prove they can use those advantages to adapt.

“It’s not just about the moat. If you don’t have a compelling AI product strategy or story, it will be very hard to convince a buyer to make an investment,” says Litchford. In theory, then, the strongest valuations should be for companies with the most AI-ready strategy, which also happen to have all the traditional defenses against competition.

Lower margins

Pricing isn’t the only pressure point. Margins are too. The CEO of Notion recently told the Wall Street Journal that 10 percent of its profit margin now goes straight to AI providers. “Gross margins are lower because there’s a new cost called AI tokens or compute costs,” says Constanza Diaz, who backs SaaS founders as an investment manager at Octopus Ventures. Litchford also warns that costs could escalate fast. “I remember Uber used to be 20 bucks. They got everyone on the platform excited, and now it’s so expensive it’s unreal. It’s cost-prohibitive. And I think there’s that risk with AI too.”

The cloud transition offers a precedent. “There were incumbents who said, ‘My customers want a cloud product, I think it’s better, I’m going to invest, even though it’s expensive and I’m cannibalizing my profit pools.’ They’re the ones who emerged [stronger],” she says, referring to legacy software firms that built cloud products at the expense of their existing solutions. “I think the same is true here for AI,” she says.

For investors, the key message is that valuations hinge less on today’s revenue model than on whether a company can adapt. Litchford and Diaz both expect large SaaS firms to adjust, as they did during the cloud shift. The biggest winners will be those who make themselves AI-ready and try out new pricing models, even if it means decimating the old ones. The losers will be the single-feature specialists whose product is easiest to replicate.

The rise of AI agents is forcing SaaS companies to question the per-seat model that drove the sector’s extraordinary success, as what once looked like guaranteed recurring revenue looks increasingly fragile. The firms that adapt their pricing and their products will keep their place at the table. The rest risk losing their seat.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofTechnology

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.