AI Promises to Make Private Equity Faster as Competition Heats Up

Startups like OffDeal and Clarum are showing how AI can cut out the grunt work from investment banking and private equity, but billion-dollar deals still need humans, for now.

- Investment bank startup OffDeal strips back investment banking, promising to close deals faster with a smaller team.

A 25-year-old banker earning a $2m bonus sounds like a Wall Street success story, but Sam Mielke isn’t at Goldman Sachs or JPMorgan. He works at OffDeal, a one-year-old startup that is pitching itself as “the world’s first AI native investment bank”.

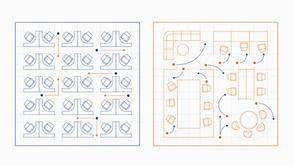

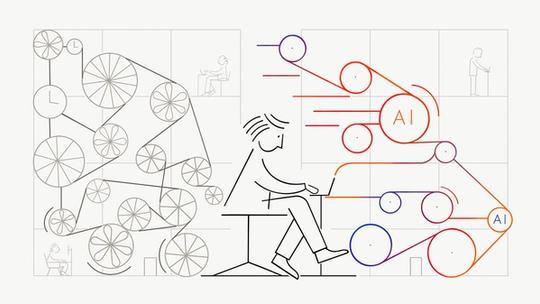

Instead of teams of junior analysts pulling all-nighters in Excel, OffDeal says it uses AI to scrape data and automate workflows, doing most of the grind of finding buyers and sellers of small and medium-sized businesses. Other AI tools draft documents, manage data rooms and email bidders automatically. A team of three bankers is left to run the auction and keep clients calm and informed. As of July, the company told the Financial Times it has already closed (or is near to completing) 10 deals, and aims to reach $100m in annual run-rate revenue in 2027. For a traditional boutique M&A firm, that would be a coup, and it’s even more remarkable considering it employs only about 10 staff in total.

This example explains some of the allure of AI for the financial world, but compared with the larger investment banking industry or the $6tn of assets under management in private equity as of July 2025, OffDeal’s numbers barely register. The leap from automating much of the work at one small firm to the wider investment world is immense.

PE meets AI

One person trying to make that ambition real is tech engineer Anton Otaner, one of the founders of startup Clarum, who was in the same Y Combinator batch as OffDeal’s CEO, Ori Eldarov. “He [Eldarov] gave us a lot of advice at the beginning,” says Otaner. “He said PE is extremely well served in terms of their audience and their tech stack that they use, but also that no two PE firms are the same. Trying to change the whole stack is very hard; you can only change a part of it.”

OffDeal targets a very specific niche in investment banking, promoting and securing the sale of smaller companies – one example is a Montessori school in Arizona – a corner of the market which, in theory, is less profitable for larger, legacy bankers, and therefore has less competition. By contrast, Clarum began with a bigger ambition of automating every stage of diligence in PE, including confirmatory diligence. “It was a huge mistake,” says Otaner, who learned that the risks at this stage mean it’s best to leave that intensive work and sign off to a Big Four accounting firm. “At early stages of diligence, you can afford to be quicker and maybe make a mistake here or there. Confirmatory diligence is different. That will probably be the last thing AI ever does.”

The turning point for Clarum came when a handful of family offices and PE firms let them shadow their analysts. Sitting alongside them, Otaner and his engineers saw the grind up close, with analysts repeatedly building similar financial models and one-pagers, distilling 100-page confidential information memoranda (CIMs) into slides. “We realized it would take six hours of code to make sure you never had to do this again,” he says. That discovery set Clarum on its current path. Today, the startup focuses on early screening and processing of these CIMs, the start of the PE funnel, and is expanding from there. “This is an area that’s very simple for AI, but it has very high leverage,” says Otaner.

“Ripe for innovation”

The next stage of the PE investment process, testing whether a business fits the firm’s thesis and has value-creation potential, is harder, and can take 20-25 hours for an analyst. “If you can bring this down to a three-hour task, which is where Clarum is very focused right now, that is the second path that I think is very ripe for innovation,” says Otaner.

This is echoed by Christoph Gugelmann, who built and sold Tradeteq, a fintech platform, to private equity in May. “If you can automate 50 percent of the work, that’s a great win. And it’s not just the automation in terms of cost reduction, it’s also the speed [improvements],” he says. Speed matters because competition in PE has exploded in recent years. “There are 10,000-plus PE firms out there, so it’s harder. If you’re faster, you get a bit of the apple, potentially,” he says. He points to EQT’s Motherbrain platform as proof that the biggest firms are already investing heavily. “They’ve been building this for a long time. Pretty much all the big ones have a project underway that is addressing a few areas,” he says.

Albert Azis-Clauson, who runs Tramlines, a London-based venture investing firm that is trying to align with private equity’s management and exit fee model, also sees selective use of AI as the best way to boost productivity and returns. His team doesn’t just deploy investors’ cash; it also uses AI to map processes end-to-end, using agents to automate repetitive tasks from contract review to interview transcription, which, in one project, he says, cut the amount of work by 80 percent and let staff do 40 percent more interviews. “Suddenly, a very long job is now very short,” he says. As for the prospect of complete, end-to-end automation? “That’s not AI. That’s magic,” he says.

EQT’s Chris Litchford, a technology specialist and partner, says that the firm has built tools to automate much of the sourcing process for deals, ranking potential targets by attractiveness across a range of criteria. “Instead of some of our competitors who might hire analysts for $85,000 a year to cold call and gather that information, [we’re asking] if some tooling gives you 85 percent of that… and we can use it across the entire group,” he says.

For now, the consensus is that AI will speed up the drudge work of private equity, but stop short of replacing people who close billion-dollar deals. Screening and early diligence are ripe for automation, while confirmatory checks and negotiation are not. The first “AI-native” private equity firm is therefore likely to be a hybrid with software helping the fund find more deals, filter them faster and redeploy analysts to higher-value work.

OffDeal has shown how far technology can go in stripping down a small investment bank. The leap to private equity is far greater. But if even part of the $6tn industry follows that route, the next 25-year-old walking away with a seven-figure bonus might not be on Wall Street, but inside an AI-powered buyout shop.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofTechnology

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.