Arvindh Kumar: The EQT View on AI Investing

Arvindh Kumar, Co-Head of Technology in EQT’s Private Equity division, explains how he appraises investments in such a fast-moving industry.

- Download EQT's full report on The AI Opportunity .

AI is eating the world, just as software was 15 years ago. In the summer of 2025, 46 percent of U.S. adults reported using LLMs at work, and Salesforce’s latest Slack Workforce Index, a survey of 5,000 workers worldwide, found that independent usage of AI tools jumped 233 percent in the first half of the year.

Nowhere is this clearer than in coding. In three years, software engineers have gone from directly manipulating text within an integrated development environment (IDE) with basic auto-complete to writing prompts for AI agents that generate, test and debug code. The shift isn’t total, and coding agents are not (yet) great engineers, but the mass change in working habits and its impact on hiring junior engineers speak for themselves. Workers aged 22-25 in the most AI-exposed occupations, such as software engineers and customer service agents, have experienced a 13 percent relative decline in employment, according to a paper from researchers at Stanford University published in August 2025.

That said, agentic AI will not immediately displace and disintermediate everything. Looking again at the impact on the job market so far, the decrease in employment is concentrated in occupations where AI is more likely to automate, rather than augment, human labor. Employment for workers in less exposed fields and more experienced workers in the same occupations has remained stable or continued to grow.

Even so, the rapid pace has changed how we think as investors.

AI disruption risk is now the number one focus of due diligence, whereas just three years ago, it wasn’t a priority. There are now two questions we ask at the start of every deal:

- Is the company we’re evaluating at risk of disruption from AI-native competitors?

- If not, is it positioned to control its own destiny and innovate from a position of strength?

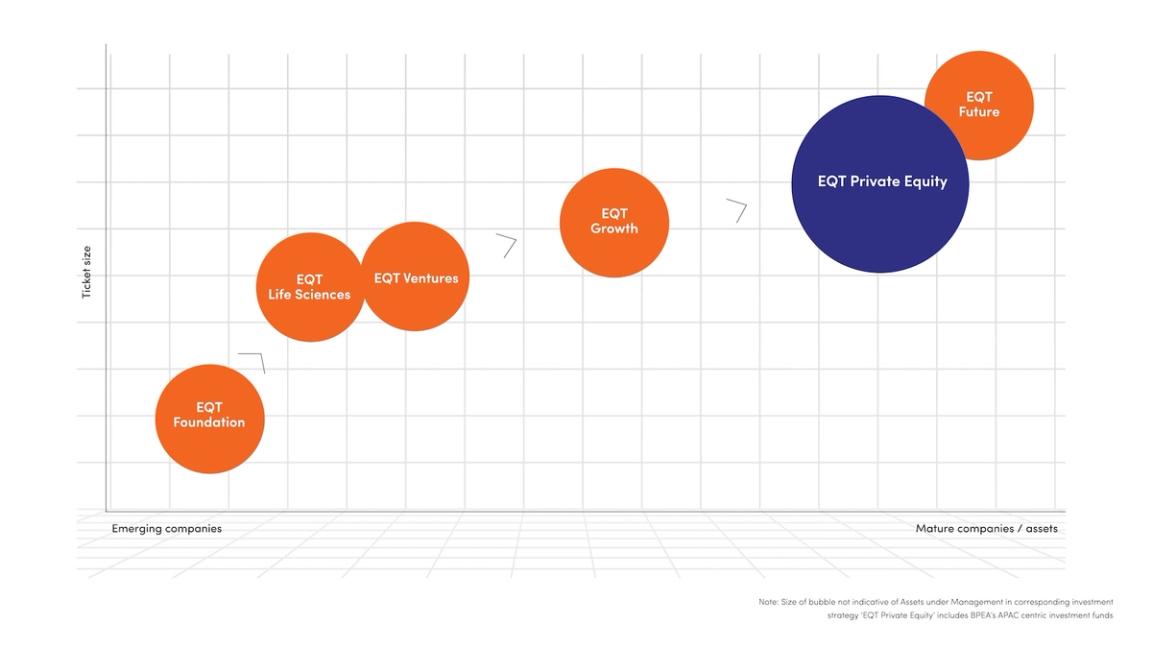

Because we have a multi-stage view – across venture, growth and buyout – we can identify where the best risk-reward is in a certain vertical, type of software and stage. It lets us bet on where we think AI-native disruptors will win versus where incumbents have an advantage. The winners won’t only be AI-natives, opening the door for exciting investments outside of the U.S. Market leaders and established companies with customers, proprietary data and control of workflows are best positioned to capture the efficiency gains and opportunities for innovation of using agentic AI.

EQT's investing universe

Casting our eye across the globe, we’re looking for companies that can leverage their 20 years’ experience in business – their customers, relationships, data and technical moats – to develop valuable AI applications. The goal is to put them on the front-end of innovation rather than leave them vulnerable to disruption from AI-natives.

Waystar’s AI approach

Take Waystar, which provides software that simplifies healthcare payments in the U.S. Its moat comes from entrenched payer integrations, regulatory certifications and long sales cycles – barriers that make it hard for startups to compete. Integrating AI into its product offering could help increase Waystar’s total addressable market (TAM) to $20bn by 2027. AI’s impact here isn’t just efficiency, but market expansion. Software companies embedding AI into existing workflows could eventually eat into adjacent service layers previously contracted out to business process outsourcing (BPO) companies.

Even companies at low risk of disruption can and should use AI to innovate, because they already own those workflows and customer relationships. For example, Storable, which provides software to the self-storage and marina industries, is fully vertically integrated, doing everything from lead-gen marketplaces and payment processing to insurance and access control. This means they face very low threat from AI natives due to vertical control, but they also have a lot of value they could capture by deploying AI and agents for pricing, revenue visibility, customer insights, and strategic real estate decisions.

We expect all companies to be AI companies in three to five years, using AI natively across go-to-market, products and operations. If they don’t, they will become obsolete. It will be like the internet today – it is just the medium in which all work is done.

Deploying AI

The biggest challenge in deploying agentic AI for these companies is cultural and organizational. Culture change really needs to come from the CEO and the executive team, then work its way down. Spending on tools without redesigning processes or workflows will cause pilots to fail. This aligns with the findings of MIT NANDA’s State of AI in Business 2025 report. One of the biggest reasons for pilot failures was not that the models weren’t capable enough, but that people and organizations did not understand how to use the AI tools properly, or how to design workflows that could capture the benefits of AI while minimizing downside risks.

Despite the challenges, AI has the potential to surpass the scale of disruption caused by the internet, mobile and cloud. It’s irrefutable that the impact will be massive. It’s just how massive?

Arvindh Kumar is a Partner and Co-Head of EQT's Global Technology Sector Team, based in the New York office. He joined EQT Partners in January 2020. Arvindh has a B.S. in Economics from the University of Pennsylvania's Wharton School and an MBA from Harvard Business School. Prior to joining EQT Partners, Arvindh was a General Partner at ICONIQ Capital, where he was responsible for leading its technology private equity practice. Previously, he was a Principal at Thoma Bravo focused on enterprise software. Other prior roles include Prospect Capital Management and Morgan Stanley.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofEurope and Technology

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.