The Rise of Continuation Funds in Private Equity

Continuation fund transactions made up almost 10 percent of private equity distributions to investors in 2023. They are increasingly seen as an attractive exit route amid a scarcity of other options, providing vital liquidity for investors.

- Continuation funds buy assets from another fund managed by the same private equity firm.

Continuation funds are a type of secondary market private equity (PE) fund created and managed by a PE firm. These continuation funds buy assets from existing funds that are managed by the same PE firm. So rather than a PE fund selling an asset it is invested in to a third party, as is usually the case, the fund sells an asset it currently holds to this new continuation fund that the PE firm also manages.

Continuation funds allow PE firms to hold on to assets – for example, part of a company or the whole business – for longer than the typical fund term.

This may be because the asset is desirable – and the PE firm wants to keep hold of it to increase its value further. Alternatively, the asset could be having problems – and the PE firm wants longer to turn it around.

For existing investors, continuation funds also offer a way to bridge the liquidity gap. They give investors a useful choice – either cash out of an investment before it’s put into a continuation fund or roll it over to the new fund and remain invested.

Why continuation funds are on the rise

Historically, continuation funds have been seen as a solution to the constraints of the traditional private equity model by enabling PE fund managers to keep hold of assets beyond the typical 10-year fund term.

Continuation funds remain a way for current investors to potentially reap more rewards from an asset for longer or see it reach its full potential .

For new investors in the continuation fund, the attraction is an opportunity to invest in more mature assets with holding periods that are shorter, relative to the holding period of a primary fund.

However, more recently, the rise of continuation funds has been led by a pressing demand for liquidity, as an alternative exit strategy for existing investors keen for cash and a return on capital.

This is against a backdrop of much higher interest rates over the past two years that has seen capital shift away from long-term growth assets like PE to short-term, lower-risk, interest-bearing assets.

Such an environment has led to a liquidity crunch in private equity. Consequently, secondary PE funds – with their ability to provide an exit for current investors – like continuation funds, grew faster than any other asset class in 2023, Bain & Co. found.

Continuation fund transactions were estimated to have accounted for nine percent of total PE distributions to limited partners – investors – in 2023, up from five percent in 2022, as an increasingly attractive exit route amid a scarcity of other options.

In continuation fund transactions, current investors are given the option to sell their stake for a pro-rata amount of the cash price of the asset, roll over their share into the continuation fund, or sell some of their stake and roll over the rest.

An investor who chooses to cash out benefits from locking in unrealized gains. They also gain the ability to rebalance and de-risk their portfolios, and deploy their capital elsewhere.

For new investors in a continuation fund, on the other hand, as this means the PE firm they are investing with now has a much better idea of the makeup and potential of the underlying asset, which should help them get the best out of it.

Continuation funds also allow the PE firm and the new lead investors to negotiate new arrangements around fees, carried interest and governance.

What does this mean for exit strategies?

While the liquidity crunch providing the current catalyst for the growth in the use of continuation funds won’t last forever – interest rates are already beginning to fall – even as exit markets slowly recover, demand for this type of secondary fund looks set to continue.

This is because, as well as providing liquidity to limited partner investors, continuation funds offer an alternative to the practice of PE firms selling to rival PE firms – sponsor-to-sponsor deals – which, according to Bain, account for nearly 30 percent of all buyout-backed exit activity.

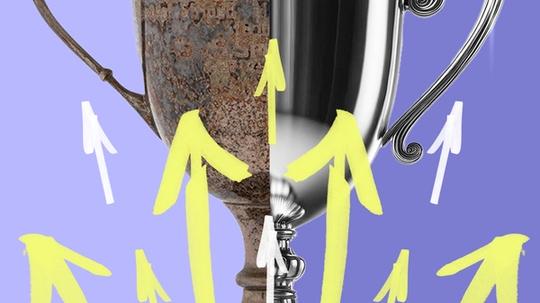

Instead of these deals, continuation funds could provide PE firms a second bite of the cherry, rather than having to sell their best assets to a rival and hand over the benefit of future returns.

At the same time, in another alternative to selling an asset to a rival PE firm, buyout firms are providing funding by backing peers’ continuation vehicles.

Fair dealing will be key to the ongoing rise of continuation funds. Conflicts of interest are present because the PE manager sits on both the sell-side, as in the existing fund, and the buy-side, the continuation fund.

The main conflicts of interest are the pricing of the underlying assets, the PE manager’s motivation for selling the asset to a related continuation fund, and the financial terms the manager may receive from investors in that new fund, for example, higher fees.

These issues can be addressed, for example, by approaching a third party such as an independent financial adviser, to assess whether the transaction process was structured in a way that ensures a fair price, to mitigate the inherent conflict of interest.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]