Gautam Nadella: Four Key Factors in Private Equity Investing

EQT’s Gautam Nadella outlines his pitch to look beyond public stock markets.

Private markets are having a moment in the sun, particularly for the high-net-worth crowd. There are many reasons for this, including the number and variety of potential growth opportunities, the impact of active ownership, and a historically strong return profile. Furthermore, while public markets have strengths of their own, such as greater liquidity, many can to various extent be provided as well in the private markets, such as through many newly formed evergreen vehicles.

Private markets dominate the landscape

While the public markets attract a lot of media attention, the majority of businesses are in private hands: an analysis of global companies with more than $100m in annual revenue shows that only 10 percent are public. In recent years, companies like SpaceX, ByteDance and Stripe have grown to huge valuations while remaining private. By restricting themselves to public companies, investors may be missing out on many exciting opportunities.

This shift towards private markets is, if anything, accelerating. In many countries – and particularly the U.S. – public markets are shrinking as companies stay private rather than enduring the process of listing. Regulations introduced over the past two decades have made it more difficult for great companies to go public. It’s one reason they are staying private longer – and creating tremendous value in that time.

Two examples really make this point stand out. The first is Amazon, which joined the stock market in 1997, less than two years after opening its online store. Anyone who was lucky enough to buy the shares at that initial public offering (IPO) has seen them climb more than 3,000-fold. In today’s world, however, OpenAI and many other leading AI firms have been able to raise billions of dollars from private market investors without having to consider an IPO. As a result, almost all of the tremendous wealth created by these recent winners has been captured by the private markets.

Active value creation drives stronger returns

Another reason why private equity is exciting involves what we call value creation levers. There are three main ways that PE firms can increase the value of the companies they back:

Multiple expansion, where a growing economy lifts all boats Financial engineering, where a PE-backed company takes on leverage for a variety of reasons Operational improvements, where a PE firm helps a portfolio company grow

Operational improvements can include various levers, such as strong governance, digital transformation, go-to-market strategies, and hiring the right talent. These things can materially move the needle for a PE-backed company, which they might struggle to implement as a standalone.

Back in the 80s, only 18 percent of value created by private equity was from operational improvements, but by the 2010s that had grown to 48 percent, according to data from Boston Consulting Group. We believe there is no reason for this trend to reverse, and given EQT’s active ownership approach, we believe this works in our favor.

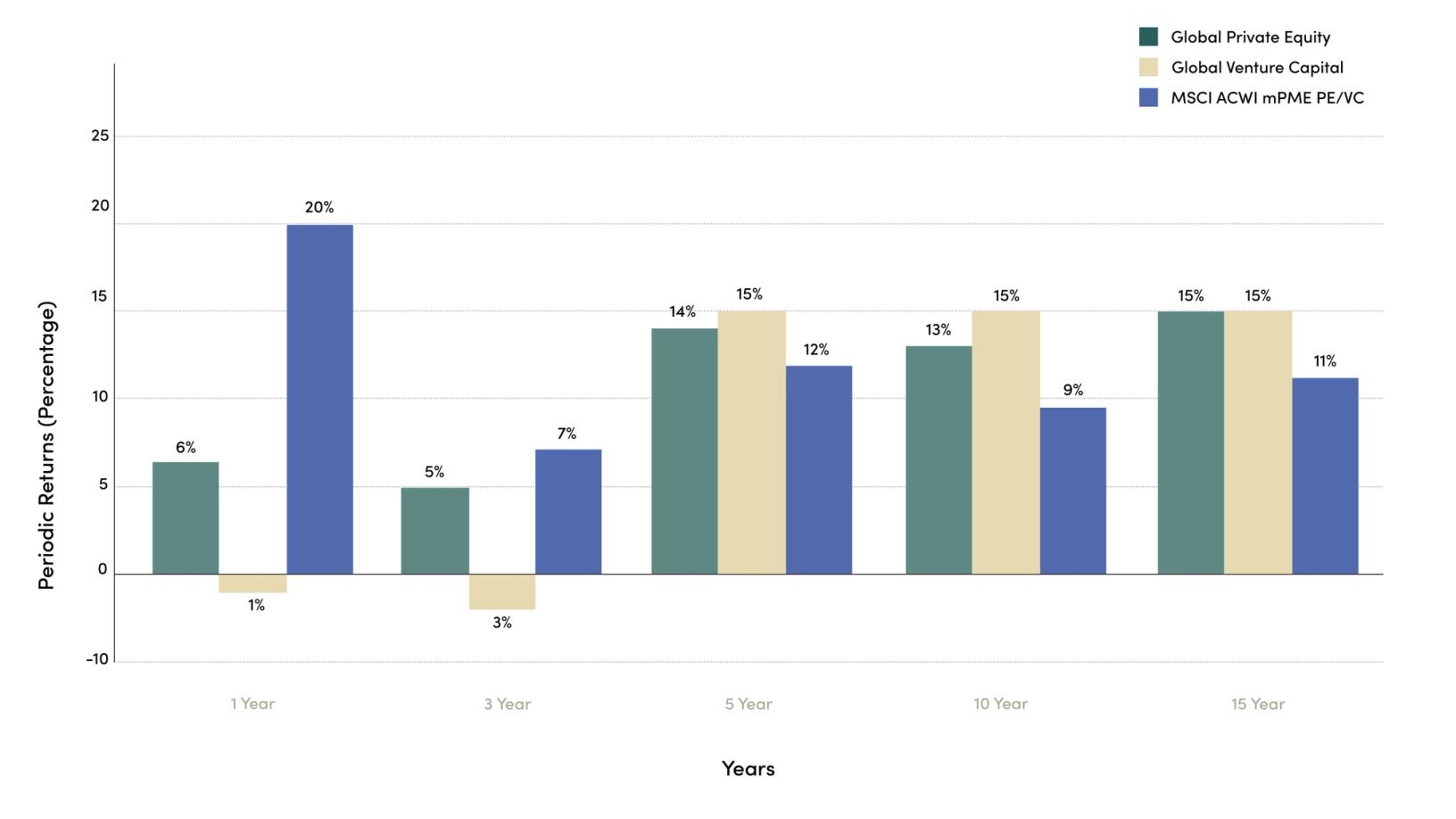

Returns over time tell the story

Finally, when judged by the ultimate metric – returns – private equity has historically beaten public markets over the longer term. Over the 15 years through June 2024, for example, an index of private equity returns compiled by Cambridge Associates climbed by 15 percent a year, while a measure of global public stock markets gained 11 percent a year.

Source: Cambridge Associates

The pitch from private equity firms is that they are able to select the best companies and add the most value to them in a way that public markets cannot. Additionally, private equity investments have often proven more resilient in times of crisis. During the dotcom crash or the Covid-19 pandemic, for example, private equity firms were primed and ready to step in and acquire businesses that needed help as public markets tumbled. Buyout deal value surged to $1tn in 2021, double the pre-pandemic levels, according to data compiled by Bain & Co.

It is worth noting that not all private equity firms are equal. In this industry there is a wide gap between the best performing investors and the worst. The leading players have greater room to stand out, as they can scale their efforts around sourcing, value creation and financing. Although, of course, historic returns are not necessarily a guarantee of future performance.

Strengths of public markets

Naturally, there are a few areas where public markets offer a superior experience to investors over private equity, and it is important to address them.

One that is often raised is liquidity. Investors who place their money in public stock market funds can generally withdraw it within a day or two if they need access unexpectedly. Private equity investments have traditionally required people to lock up their money for several years – although a new generation of so-called evergreen strategies, or semi-liquid strategies, allows earlier withdrawals under certain circumstances.

Another benefit of public markets is not having to rely on manager selection as much as with private equity. Funds investing in public markets can make investment changes on a dime, but if you select a poor PE manager, you can be wedded to them for a long time.

Finally, the fees charged on PE investments are usually higher than for simple products like an S&P 500 index fund. As a result, while returns have been stronger in recent history, the research involved in selecting private market investments is higher.

The key lesson here is that investors should not overlook private markets. They are bigger and more diversified than public markets. Furthermore, great opportunities are more likely to be found in private versus public markets, because fewer investors are able to access private markets at all. This combination allows private equity firms to be selective in what they acquire, seek to add material value to the businesses they select, and thus allow them to pass that value on to their investors. In the end, this has the potential to add up to strong returns over a longer period of time for private markets.

Gautam Nadella is the CEO of EQT's US private equity operating company and is also a member of its Board of Directors and Investment Committee. He joined EQT in 2021 previously as an Operating Partner, leading M&A, fundraising, and strategy for many portfolio companies. Before EQT, he was a senior leader, driving M&A, investments, and strategy since 2001, most recently in Corporate Development at Next Insurance and Corporate and Business Development at BlueCat. His previous roles include senior leadership positions in Corporate and Business Development along with Investments at eBay and Cisco, and he began his career at McKinsey & Company. He holds a B.S. in Mathematical and Computational Science and an M.S. in Management Science and Engineering from Stanford University, and an M.B.A. from Harvard Business School

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofPrivate Equity

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.