Understanding Cap Tables and Dilution

Understanding cap tables and how they reflect company equity ownership is essential for founders and investors alike.

- Capitalization or ‘cap’ tables break down a company’s equity ownership structure.

Capitalization tables (‘cap tables’) are an essential tool for understanding and managing company equity, financial planning, and fundraising. They record a company’s ownership structure, detailing who owns what stake and its value. They are updated regularly to reflect changes in ownership and dilution over time, and can be used to assess the impact of future funding rounds on existing shareholders.

Cap tables are especially critical for the founder and investors in startup and early-stage companies, as ownership can change quickly during the initial stages of growth.

Different types of cap tables

- Basic cap tables list the total market value of a company, the names of equity holders, the number of shares each shareholder holds, the percentage of the company each shareholder owns, the types of equity ownership, and the share prices.

- More complex cap tables may include transaction and valuation history, potential new funding sources, and potential exit strategies such as acquisitions and public offerings.

Who uses and manages cap tables?

Startup founders maintain and update cap tables to inform planning for future funding and equity allocation and manage potential dilution. As companies grow, a finance manager, controller, or operations team member typically takes over.

In the case of equity agreements or share issuance, company lawyers will ensure the cap table reflects the legal reality and is compliant with securities law. For late-stage companies or those about to exit, the CFO or external advisors will help manage and present cap tables to buyers, investors, or regulators.

For investors, the cap table is a key part of due diligence, helping them to assess investment risk and potential returns. A well-maintained and accurate cap table helps reduce delays and legal risks during an acquisition, merger or IPO.

How cap tables reflect dilution

After each funding round or issue of equity, the cap table shows how existing owners’ shares are reduced or ‘diluted’. Understanding dilution is crucial because it directly affects how much of a company a stakeholder actually owns – and therefore how much control, value, and potential return they receive.

There are two types of dilution:

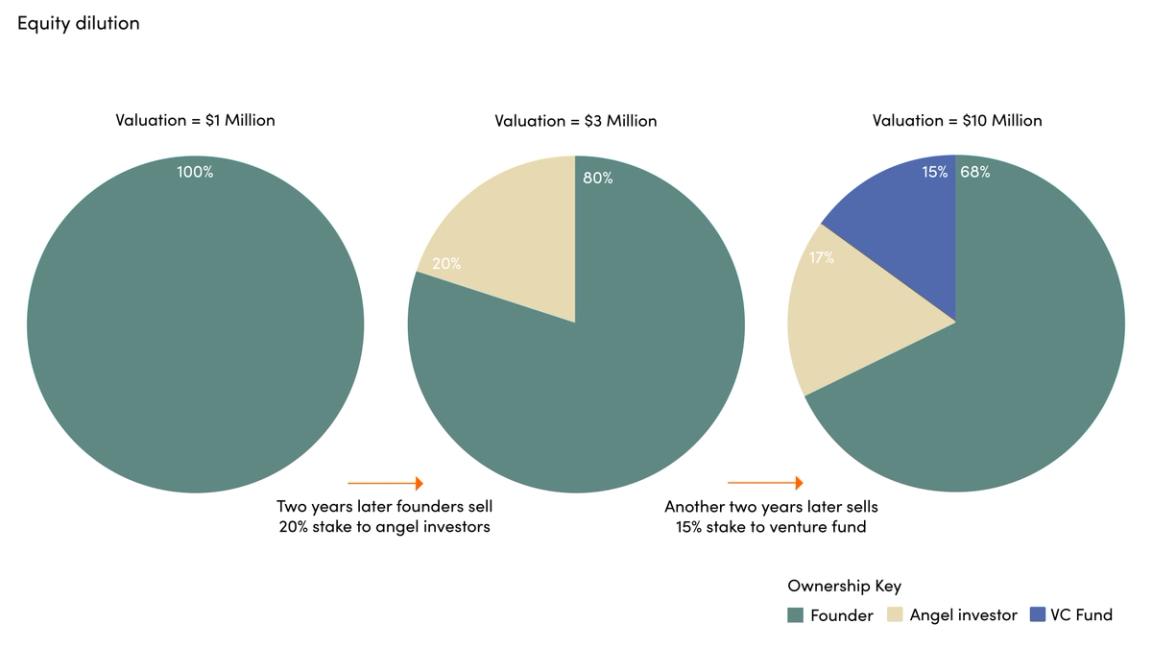

1. Equity dilution refers to a decrease in existing shareholders’ ownership percentage and occurs when a company issues new shares.

If, say, the founder of a company raises money from an angel investor for the first time, and the investor acquires a 20 percent stake, the company issues new shares to its investors, diluting the founder’s equity from 100 percent to 80 percent.

Then, in a subsequent round, a venture capital fund acquires a 15 percent stake in the company. After the company issues the shares, the venture capital fund owns 15 percent, diluting the angel investor’s stake to 17 percent and the founders’ stake to 68 percent.

It’s easy to see how significant dilution can occur after multiple funding rounds. For instance, Uber went through 18 rounds before its 2019 IPO. At that point, Uber co-founder Garrett Camp’s startup studio Expa’s share stood at just 6 percent.

2. Value dilution occurs when a shareholder’s stake in the company decreases in value, usually because new shares have been issued at a lower price without a proportional increase in the company’s overall value (known as a ‘down round’).

Imagine a company worth $1,000 with 100 total shares. If an investor owns 10 percent of the company, then they own 10 shares worth $100 ($10 per share). If the company then sells 50 new shares at a lower valuation of $400 ($8 per share), there are now 150 shares total, meaning the investor’s ownership percentage has decreased to 6.67 percent, and the dollar value of their 10 shares has decreased to $93.33.

Take WeWork. After a failed IPO attempt in 2019, the office-space startup raised a rescue funding round at a much lower valuation ($2.9bn, down from its private valuation of $47bn). This ‘down round’ led to dilution for existing shareholders, whose ownership was devalued, despite holding the same number of shares.

Convertible notes and stock options

Value dilution can also occur when companies raise money through convertible notes – a type of short-term loan from an investor that is eventually converted into shares rather than paid back in cash. When convertible notes are converted into shares, the total share count increases. If this happens without the value per share having increased, the result is dilution.

Many startups also reserve a portion of shares (10 to 20 percent on average) for an employee stock option pool. When those options are exercised, for example, at IPO or an acquisition, they convert into shares, diluting other shareholders’ ownership unless the shares were already accounted for in the fully diluted cap table.

Mitigating dilution

Anti-dilution provisions (known as subscription rights, subscription privileges, or preemptive rights) are designed to protect investors’ ownership value if a company issues new shares at a lower price.

These clauses are built into convertible preferred stocks and options, and come in two types:

- Full-ratchet dilution fully adjusts the investor’s original share price to match the new, lower price, regardless of how many shares are issued in the new round. It protects investors but dilutes founders and employees.

- Weighted dilution partially adjusts the investor’s share price, based on the number of new shares issued and the price difference. It’s regarded as a fairer approach that protects the interests of both investors and founders.

Ownership dilution is likely to be unavoidable for any founder building a venture-scale business. It should not be viewed negatively, provided the company has taken a considered and long-term approach to its cap table and is issuing new shares strategically to drive growth. That growth should lead to a higher overall valuation, increasing the value of each share and offsetting the equity dilution – this is known as ‘accretive’ dilution.

Early cap table decisions are likely to have a long-lasting impact on a company’s ability to raise capital and reward employees as it scales. Thoughtful cap table management and a clear understanding of the different types of dilution are, therefore, essential.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]