Evolution, not Revolution: Financial Modelling in Private Equity

The advent of advanced tooling and large-scale data analysis is changing the financial modelling process.

- Financial modelling is fundamental to the PE deal cycle, with Associates traditionally building a variety of models in Excel.

Financial modelling sits at the core of the private equity (PE) dealmaking process. Without it, investors cannot have sufficient confidence in the risks and opportunities of a potential investment. It is integral to the entire deal cycle, from deal evaluation through to post-acquisition planning. Junior personnel, often called Associates, are typically responsible for building financial models and tailoring them to the requirements of directors and partners. Traditionally, strong financial fundamentals have been the key attribute. However, as associates increasingly incorporate AI tools into their day-to-day, broader tech skills are becoming more important.

Traditional modelling

Associates have traditionally built financial models in Excel. Some of the most common models include a three-statement model, which links a company’s income statement, balance sheet and cash flow statement; a discounted cash flow (DCF), which values a potential investment based on the present value of its estimated future cash flows; and a leveraged buyout (LBO), which assesses the potential internal rate of return (IRR) of a debt-financed acquisition.

Financial modelling is relevant at each stage of the deal cycle, from acquisition to disposal, with some models used at multiple stages.

- Acquisition: An LBO model, complete with debt schedules, will inform negotiations around the deal’s capital structure with other stakeholders such as banks, target management, and co-investors.

- Monitoring: Post-acquisition, a fund’s operating model monitors an investment’s performance versus various key performance indicators and identifies value creation opportunities. Within this, a three-statement model tracks cash flow.

- Exit: A fund will run a variety of different models to help identify the best exit opportunities. For example, an IPO (Initial Public Offering) model assesses whether to exit via public markets.

Sensitivity and scenario analyses are a key feature of financial models. Associates use these to assess a range of outcomes under different variables. These analyses act as a bridge between number-crunching and decision-making.

Evolution by AI

Financial modelling is evolving as associates increasingly leverage Artificial Intelligence (AI). Currently, this largely entails using Large Language Models (LLMs) such as ChatGPT to improve efficiency, most notably in coding and research.

However, associates are still unlikely to use AI to build entire models. “When it comes to the PE deal workflow, it [the evolution towards advanced modelling] is not happening as fast as you think,” says Rob Langrick, Chief Product Advocate at the CFA institute. “The trust in the new tools is not yet high enough for the tools to be used widely in doing an LBO model. Plus, Excel Copilot is still at the nascent stage. That being said, many smaller elements may be accelerated, for instance having Copilot build a Visual Basic for Applications (VBA) button”.

This may soon change. Tools such as Mosaic and Zillion purport to scan thousands of documents to identify target companies and benchmark them versus peers, potentially saving associates hours of number crunching. Such tools also claim to generate a full LBO model for a target within minutes, relying on only a few manual inputs such as the purchase price, sources and uses of funds, and capital structure. Larger firms are also developing proprietary AI tools, such as EQT’s own Motherbrain. Motherbrain is a database of past deals which uses data and AI to provide pattern recognition and insights for deal teams.

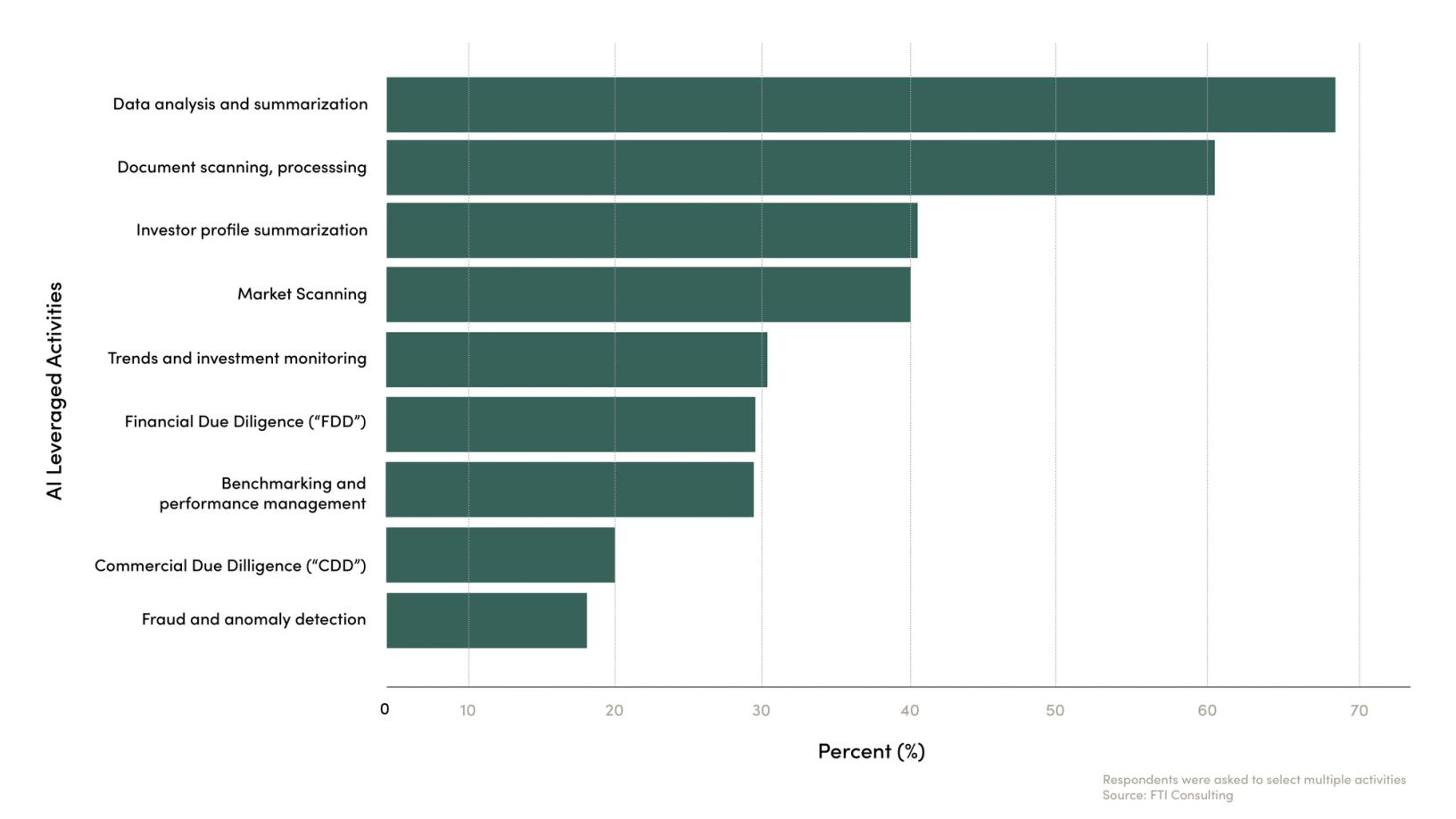

The mere promise of new technologies is not sufficient per se to change financial modelling – PE firms must also adopt them. Adoption is highest for more manual processes, such as document scanning and data summarization, according to a survey by FTI consulting. Adoption tends to be lower for more modelling-heavy processes such as financial due diligence and performance management.

Source: FTI Consulting

There are barriers to adopting new technologies, as highlighted in Allvue’s 2025 GP Outlook survey. Regulatory and compliance concerns are foremost, as investment decisions must comply with local financial regulations. Firms must also have confidence in the quality of the data that new technologies are leveraging.

Firms may also be reluctant to disrupt existing modelling workflows by integrating new technologies with their legacy systems, and to retrain employees with already hectic schedules. Although on-the-job AI training is still in its infancy, firms are increasingly likely to provide this. EQT, for example, has a dedicated channel demonstrating how LLMs can help with modelling, as well as other daily tasks.

Two areas where Associates are already using AI to advance financial models are coding and research. Coding use-cases range from refining Excel formulas to automating data-heavy spreadsheets and writing code for VBA, all of which have the potential to save Associates considerable time.

Realising that potential, however, requires strong prompting skills.

Elsewhere, deep research tools can swiftly produce industry overviews that inform the financial metrics used in models. LLMs can make mistakes, however, so fact-checking is essential. Separately, LLMs can also parse large data sets. For example, an associate modelling a publicly listed target could use NotebookLM, an AI-powered Google tool that summarises information from uploaded documents, to isolate any sell-side research that focuses on an individual topic (e.g. revenue growth).

The day-to-day adoption of AI has the potential to improve the speed and quality of firms’ financial models through efficiency gains, reduced human error and improved risk identification. Many of these tools also contain algorithms that learn and improve over time, which should enhance their accuracy.

The speed of this evolution will depend on firms’ willingness to adopt new technologies and overcome any near-term teething issues. In the near-term, however, AI use-cases may be limited to coding and research.

Tooling up

PE professionals still require strong finance fundamentals and Excel skills, not least to navigate the exacting modelling tests that recruitment processes include. “PE professionals have had to be cutting edge with Excel, Word and PowerPoint for several decades,” notes Langrick. “On the modelling front, it is important that the Analyst or Associate follow best practice.”

In the future, associates may need more varied modelling skills than the spreadsheet jockeys of old, as advanced tooling and data analysis increasingly complement and automate legacy tools. Industry website perecruit.co.uk suggests that proficiency in AI software and data analysis tools such as SQL or Python is desirable. Positively, associates could also benefit from a more varied role that pivots towards critical thinking and decision-making and away from repetitive modelling tasks.

The pace of AI-driven disruption to the financial modelling process is uncertain. While there may come a time when employees’ tech skills are as important as financial fundamentals, for now, aspiring Associates should prioritise the latter while nurturing the former.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]