Rewriting the Private Equity Playbook to Stand Out from the Crowd

Over the past several decades, the industry has exploded in size. In the next phase of growth, firms will need a new approach.

- With the number of PE firms climbing to 6,000 in the U.S. alone, differentiation is becoming harder.

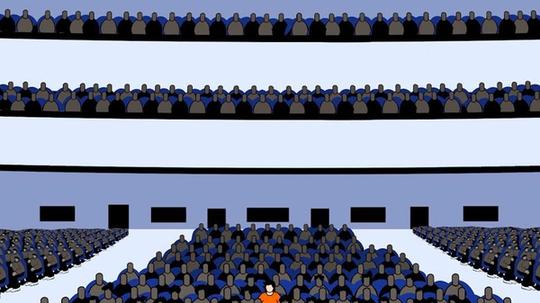

If every private equity firm in America had sent a partner to an industry meeting in 1980, you could have squeezed them all around a boardroom table. Today, you could fill New York’s Radio City Music Hall.

Over the past 45 years, the industry has experienced dramatic growth. The number of private equity (PE) firms in the U.S. has surged to about 6,000 as of 2024 from just two dozen in 1980, while assets under management have climbed to more than $3tn.

As the sector has swelled, standing out from the pack has become increasingly challenging. Facing heightened competition, companies are revamping their strategies to uncover promising investment opportunities and attract capital as they target wealthy individuals and look beyond their traditional institutional investors.

This isn’t just a U.S. trend. According to investment data firm Preqin, global PE assets under management are forecast to double to $12tn by 2029 from almost $6tn in 2023. Companies worldwide are stepping up efforts to distinguish themselves in a crowded field. Most are considering one of two paths: pursuing greater scale with multiple strategies and products or staying small and nimble and developing deep expertise in a narrow sector.

“Private equity is still a relatively young industry, and firms have to decide who they want to be when they grow up,” Michael Sidgmore, founder of podcast and content platform Alt Goes Mainstream and co-founder and partner at venture capital firm Broadhaven Ventures in New York, said in an interview. “You either need to be really big or really unique.”

Expanding Horizons

While some PE firms reshape their businesses by opening private credit funds and moving into new asset classes such as infrastructure, others are broadening their investment horizons geographically, stretching well beyond North America and Europe.

“We’re seeing an increasing willingness to do deals everywhere around the world,” Jay Scanlan, an independent PE adviser based in Washington, D.C., said in an interview.

With the number of private equity funds rising to more than 18,000 in the U.S. alone as of 2021, companies are also snapping up rivals to gain an edge. Over the past five years, the top 100 general partners made roughly three times as many acquisitions of competing GPs as they did in the prior five years, according to McKinsey.

New Investors

Rising interest among wealthy individuals is one of the key factors driving firms to reassess their strategies. Bain & Co. estimates that a wider group of investors, ranging from ultra-high-net-worth individuals to the “mass affluent” — or people with less than $1 million to invest — will account for a quarter of the growth in alternative assets between 2023 and 2033. The opportunity is significant: while individual investors hold about 50 percent of global capital, they account for just 16 percent of the assets in alternative investment funds, according to Bain.

“When you think about the evolution of the industry, and where the new capital comes from, the wealth channel is becoming a much bigger part of the equation,” Broadhaven’s Sidgmore says. “There are only a certain number of firms that can service the wealth channel and service them well.”

Some private equity firms are opening the door to retail investors, forming partnerships with traditional asset managers to tap into their distribution networks or building up their commercial and investor relations capabilities, recognizing that the “lunch-and-a-handshake” approach of the past no longer works, according to Bain.

Others are giving individuals access to private markets at reduced fees and offering greater liquidity to appeal to investors uneasy about having their capital locked up for as long as 10 years, a typical feature of private equity investments. Those semi-liquid assets strive for balance, providing flexibility alongside potentially higher returns.

As fund managers race to seize those opportunities, they must also confront a host of challenges amid the broader backdrop of trade turmoil and geopolitical uncertainty. The industry faces rising pressure on fees as competition mounts and growing scrutiny from regulators that could impact dealmaking. As firms seek to democratize the private equity field, regulatory watchdogs will pay even more attention to the risks.

Talent and Tech

One way firms are hoping to gain an advantage is by relying more heavily on artificial intelligence. AI is putting them in a stronger position to source deals, perform due diligence, become more efficient and drive performance at the businesses they own along the way.

“In a world of increased competition, you have to become faster and more effective in evaluating opportunities, and these tools will allow you to do that,” says Scanlan, who previously led Accenture’s global PE practice. “That’s going to massively increase productivity for these firms and also for the world at large.”

Another priority is bringing in talent with more diverse skills. Focusing on improving the gender, racial and ethnic diversity of management teams is helping to “unlock access to differentiated deal flow,” BCG and Cambridge Associates research shows. Diverse teams are more likely to invest in early-stage deals and overlooked companies, the report finds.

Better and Stronger

At the same time, companies are focusing even more on increasing the value of their portfolio companies by improving their operations, aiming to build companies that will be successful and sustainable over the long term.

“There’s much greater thoughtfulness about the impact PE can have in creating economic opportunity and growing better, stronger communities,” Scanlan says. “These firms understand they have a multi-generational legacy to build upon.”

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]