How Should Businesses Think About Measuring Biodiversity?

“You need to stop causing harm first, but from there, you can move toward value creation,” says Zoe Haseman, EQT’s Infrastructure Head of Sustainability.

- Since 1970, global wildlife populations have fallen by 73 percent, and one-third of the world’s topsoil has been degraded.

Biodiversity, a measure of the variety of life found in a certain area, is under pressure in many parts of the world. If businesses are to help manage this challenge, they first need to be able to measure it. It’s an inconvenient truth that the number of plants, animals and microbes we share our planet with is rapidly declining. Since 1970, global wildlife populations have plummeted by 73 percent, and one-third of the world’s topsoil has degraded, undermining food security and agricultural resilience. Over 420 million hectares of forest, an area larger than India, have been lost, cutting off vital carbon sinks and biodiversity havens.

Beyond any ethical concerns, this creates direct challenges for many businesses. As ecosystems struggle, supply chains face rising volatility and material scarcity. Regulatory pressure is also rising, with expectations for transparency and environmental accountability expanding.

“Without nature, there is no business,” says Zoe Haseman, Infrastructure Head of Sustainability at EQT. “It really is existential stuff.” With luck, a focus on biodiversity can even go beyond mitigating risk and open pathways for growth, she explains.

Why biodiversity matters to business

More than half of the world’s economic output, some $58tn, is moderately or highly dependent on nature and its services, according to PwC. Around 75 percent of global food crops rely on biodiversity, including essential pollinators such as bees, butterflies and birds. As these natural systems falter, so too do the foundations of human life and commerce.

Some sectors are likely to feel the impact of a decline in biodiversity more acutely. Food producers, for example, depend on topsoil and pollinators for the crops behind nearly every product. However, even fewer nature-dependent sectors are exposed through supply chains.

“If you’re giving out some carbon dioxide, you are contributing to an impact on biodiversity,” says Blessing Allen-Adebayo, an independent sustainability consultant. But even if businesses cut their direct carbon emissions, the impact on biodiversity may be felt earlier in the supply chain. According to the United Nations Environment Programme, 90 percent of biodiversity loss and nearly half of global emissions stem from resource extraction and processing, often upstream in supply chains.

“Even if you’re not directly producing the raw material, you still have a supply chain linked to some environmental degradation that impacts on biodiversity,” continues Allen-Adebayo.

Measuring biodiversity

Business leaders have shown an awareness of their impact on biodiversity. In the World Economic Forum’s 2025 global risk report, the top four threats to the core value of business operations over the next decade are all related to nature or climate. Yet measures to reduce biodiversity harm have been slow and, for now, are voluntary. The 2024 Nature Action 100 report found that while many companies express ambition, none have yet taken comprehensive action.

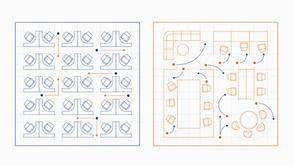

Top threats to business operations over the next decade from WEF's 2025 global risk report

Improving biodiversity measurement could help unblock this situation. Katie Fensome, Associate Director at Biodiversify, a biodiversity consultancy, explains that there are many indicators businesses can monitor and take action on. “There are protocols to measure biodiversity, but it’s very site-specific. What you would measure depends on the location and the issues that are in that location,” she says. It requires investment in data-intensive, on-the-ground monitoring and a focus on balance. Improvements in one area can unintentionally cause harm in another. “It’s not something that’s easily done at scale,” she continues.

Beyond companies themselves, there’s also a key role for investors, who haven’t always been quick to support action to reverse biodiversity loss. “It has been really challenging for investors to be able to get behind [biodiversity],” explains Haseman, pointing to the difficulty of quantifying both risk and return.

However, this may soon change. The Nature Action 100 study noted that, despite the lack of completed action, the majority of companies surveyed disclosed targets and plans for implementing measures. This commitment is accelerating, with 12 percent of Global Fortune 500 companies setting clear targets for biodiversity, double the figure of 2024.

A $10tn opportunity

Beyond the challenges, there are also opportunities. The World Economic Forum estimates that the global transition to a nature-positive economy could unlock $10.1tn in annual business opportunities by 2030. These range from cost reductions through circular systems to new revenue streams in regenerative agriculture, eco-design and green infrastructure.

Nature-related regulations are also increasing, and independent organizations such as the Taskforce on Nature-related Financial Disclosures are creating frameworks to make it easier for businesses to address biodiversity issues. Fensome explains that these frameworks are still flawed and assume that businesses already have traceability on their full supply chain. However, it’s a starting point that could be improved upon with collaboration.

Another element that could turn the dial is an increased investment focus on supporting biodiversity action. In 2025, 200 investors representing $30tn in AUM committed to support action to reverse biodiversity loss, highlighting a shift in perceptions around biodiversity action. Reframing biodiversity as a regenerative opportunity could accelerate this shift.

Moving from risk to regeneration

While much of the current corporate focus on biodiversity is framed around litigation, a growing number of companies are beginning to embed biodiversity into the core of their operations.

Allen-Adebayo sees this as a tiered journey. “Offsets or compensation schemes might be a starting point, but they’re just the minimum entry level,” she says. The real shift comes when businesses move beyond harm reduction to actively restoring biodiversity and phasing out practices that degrade ecosystems.At EQT, this thinking is already influencing investment decisions. One example is in Anticimex, a pest control portfolio company that traditionally relied on toxic chemicals. “That has a direct impact on biodiversity,” Haseman notes. “Poisoning animals spreads along the food chain. So the company has been transitioning toward more natural, nature-positive solutions, reducing harm while uncovering new business opportunities.”

This shift requires a change in mindset. As Haseman puts it, “It starts with risk mitigation, you need to stop causing harm first, but from there, you can move toward value creation.” EQT recently launched a nature value creation acceleration program across six of its portfolio companies, designed to help them explore regenerative approaches that go beyond compliance and into innovation.

The aim with this approach, explains Haseman, is to inspire people. “The risk mitigation reporting side of it isn’t really a great way to drive the hearts and minds of people,” she says. “One thing that we need to be wary of, if we set up biodiversity management in the same way that we have done with climate, potentially people will just drop off [...] If you can take a more innovative look, it actually drives interest.” Without that connection, nature initiatives risk being deprioritized in times of financial pressure.

But the key element for a business to focus on biodiversity, explains Fensome, is understanding that approaching the issue now could ensure long-term survival. “The more we degrade biodiversity and nature, the more vulnerable you are to climatic shifts and instability of the supply chain,” she says. By innovating and finding impactful ways to address biodiversity throughout the supply chain, businesses can begin to build resilience, turning nature from a risk into a strategic asset.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofSustainability

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.