Katherine Kitson: Turning Avoided Emissions into Commercial Advantage

EQT’s Katherine Kitson outlines how leveraging a company’s avoided emissions can be a significant opportunity for businesses

At EQT, we’ve always believed in supporting our portfolio companies with more than capital. When it comes to sustainability, we currently have a tremendous opportunity to be even sharper and more data-led in demonstrating that there is value in embedding sustainability into investment processes and commercial strategies. For companies providing lower-carbon solutions, this is where avoided emissions calculations can come in.

As we progress in the energy transition, avoided emissions can be a powerful tool for investors, leadership teams, and the wider market to paint a clearer picture of the full impact of lower carbon solutions. As part of our work with the Impact Convergence Forum for Private Equity, EQT recently took part in a landmark project designed to help drive further consistency as more firms model and report avoided emissions.

What are avoided emissions?

Investors will likely be familiar with Greenhouse Gas Protocol Scopes 1 to 3.

As a quick reminder, Scope 1 covers direct emissions from a company’s own activities (such as emissions from company cars), while Scope 2 accounts for indirect emissions from purchased energy (like emissions from the production of energy used to power an office). Scope 3 includes all other indirect emissions that a company causes through its suppliers and customers.

To help navigate avoided emissions calculations, EQT, alongside other investment management firms and also institutional investors, Project Frame and the World Business Council for Sustainable Development (WBCSD), recently published a guide on how to understand and apply existing methodological approaches for reporting them.

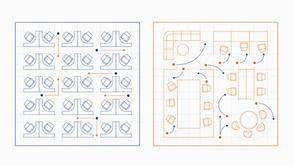

Avoided emissions do what they say on the tin; they’re emissions that didn’t happen. Take, for example, a business that uses electric vehicles instead of fossil fuel-powered ones, or a biotech company working on crops that improve yield. You can also think about sources of renewable energy – solar panels, heat pumps, or wind turbines – that replace pollutant-emitting fuels, or the use of low-temperature detergents, fuel-saving tires and LED light bulbs over more toxic substitutes.

They are quantified by comparing a real ‘low-carbon solution’ like these to a reference or baseline scenario (what would have happened otherwise). Defined system boundaries and project lifetimes are combined with assumptions for energy supply and usage, among other criteria, to calculate an auditable outcome that can be matched to a framework like the WBCSD’s.

Avoided emissions as a commercial lever

Flix, an EQT Future portfolio company, provides one example of avoided emissions in action. The Munich-based tech-enabled transportation company announced in 2024 that its customers had helped avoid 1.5 million tons of CO2 emissions across more than 40 countries and 6,800 destinations. The company calculated that a FlixBus coach in Europe emits at least five times less CO2 than private cars and at least 10 times less than an airplane flight.

Flix customers tell the company that one reason they choose FlixBus is because it is a lower-carbon and cost-effective means of long-distance transit, indicating a clear customer demand for lower-carbon offerings. By modeling, disclosing, and demonstrating its climate impact—including a third-party audit of its avoided emissions methodology—Flix gains market access and can appeal to a broader customer base, which in turn has the potential to drive top-line growth.

Likewise, work being done by EQT Infrastructure portfolio company Statera is forecast by the firm to avoid 74 million tons of carbon dioxide emissions by 2050 through investment in battery storage and flexible gas generation projects. The London-based firm is focused on low-carbon solutions as part of a drive to upgrade the UK’s electricity grid.

Looking forward

There’s no silver bullet for decarbonization. In order to limit and mitigate the effects of climate change, we need a range of solutions that address all aspects of the real economy. Avoided emissions are a useful tool for companies to show their ability to deliver those solutions, and for investors who are seeking to accelerate capital toward optimal climate solutions.

In order to unlock that full potential, alignment on more consistent methods is critical. By converging standards and sharing knowledge, investors and companies can turn avoided emissions into a credible, actionable driver of innovation and growth. The task is not perfection, but progress. EQT’s work on this guide, together with the Impact Convergence Forum, WBCSD, and Project Frame, is an important step towards consistent and comparable methodologies.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofSustainability

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.