Peter Shacalis: Can Private Capital Help Europe’s Forever Renters?

Rising costs and stagnant supply have turned renting from a stepping stone into a long-term reality for many. As private capital increasingly moves into the residential sector, can it help to fix a broken market?

Is the dream of homeownership in Europe becoming unattainable? It depends on how you look at the data. In headline terms, little appears to have changed: 68.4 percent of European Union households owned their home in 2024, down slightly from 70.7 percent in 2010.

Yet under the surface, a significant shift is happening. A study of 12 European countries found that while homeownership remained steady as a whole between 2005 and 2018, it declined by 21 percent for people under the age of 36. The trend was especially striking in the UK, where the share of 25- to 34-year-olds who owned their home declined by one-third between 2000 and 2022 to 39.1 percent.

The “missing middle”

Young people aspiring to become homeowners face a stagnating housing supply and climbing costs. Most European countries set modest housing targets and fall well short of achieving them; this year, just 64 percent of targeted homebuilding is set for delivery. Against this backdrop, the cost of buying a house has increased over the last decade: real-terms house prices in the Euro area were almost 20 percent higher in Q1 of 2025 than they had been in 2015, despite a decline from peak valuations in 2022.

The upshot is that renting, once a stepping stone towards ownership, is becoming a way of life for many people. Someone living on the average salary in London and saving 10 percent of their income would need to do so for more than 30 years in order to afford the typical deposit for a first-time buyer.

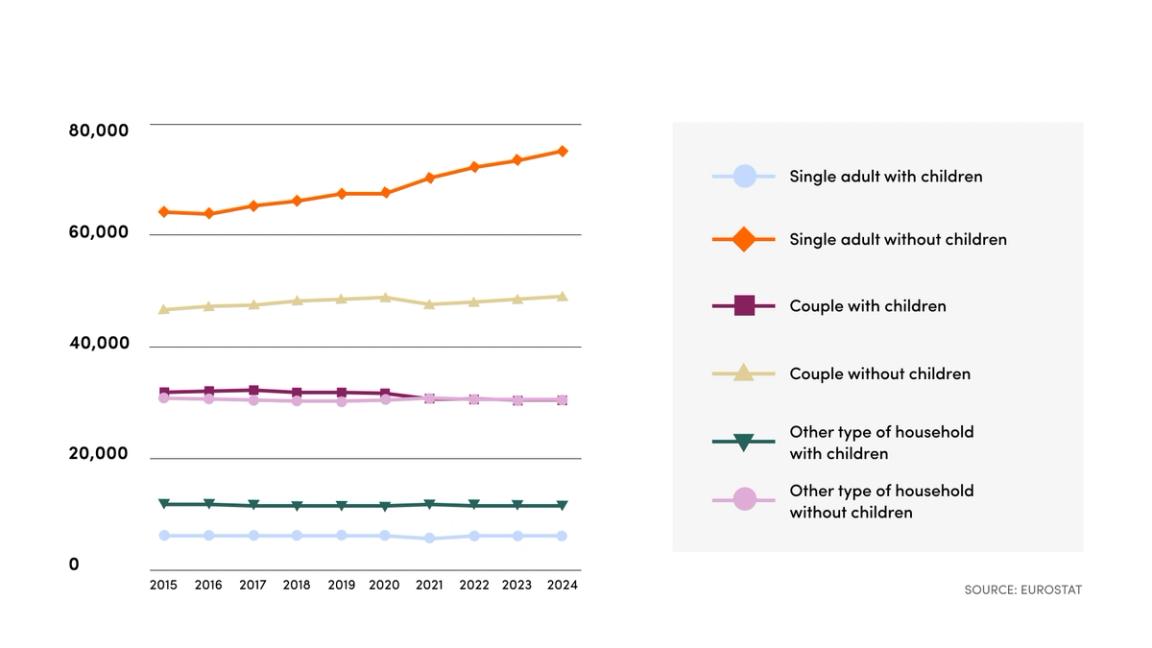

Households by type, 2015-2024 (in thousands) [Source: Eurostat]

These people are the “missing middle”, who neither qualify for social housing nor have the financial means to buy their own home. Forced into the private rental sector, many find themselves sharing with strangers and living in substandard accommodation, managed by individual landlords who face little market pressure to upgrade their properties or service levels.

Private capital moves into residential

In this testing market, private capital is increasingly playing a role. Residential real estate in Europe received €46bn of investment in 2024, a 29 percent year-over-year increase, which saw it become the most favored sector in property for the first time, ahead of office, retail, industrial and logistics. This continues a long-term trend, in which residential has more than doubled its share of the total investment volume into European real estate, from 8 percent in 2008 to 21 percent last year.

Partly that reflects capital moving out of less favored real estate asset classes, with the office market struggling to recover from Covid-19 and retail similarly challenged. However, residential offers its own attractions. Demand is robust, occupancy levels are high, and annually reviewed rents offer some inflation protection.

Demographic tailwinds also encourage investors. Although the EU population is expected to flatline in the coming years, robust household growth is still projected in cities. This is in light of a dramatic shift in how people live, with single-person households across the EU having grown by 17 percent between 2015 and 2024, while the number including couples or single adults with children declined by 4.4 percent and 1.1 percent, respectively. Other niches include Europe’s student population, which grew by 15 percent in the decade to 2023 and is set to increase another 10 percent by 2030, also showing the health of long-term demand.

While the composition of households is fast changing, the buildings they live in are not. Europe’s aging housing stock, much of which was built before 1980 and almost a fifth prior to 1946, hardly reflects this demographic shift. Nor does it provide the level of amenities rightly expected by long-term tenants.

For investors, the data is clear: there is a growing demand for housing to meet the needs of people who may rent throughout their lives, and who do not expect to spend their entire adult lives in house shares. In turn, there is an evident lack of supply to meet these needs, with the European housing shortage now estimated to be 9.6 million homes, or 3.5 percent of the total stock.

Can investment make a difference?

As investment in the residential sector has grown, one area of focus has been residential-for-rent developments. These properties currently comprise 2 percent of the private rental sector in England and Wales, but accounted for 8 percent of all housing completions last year. Between 2018 and 2022, €23bn was invested in the residential-for-rent sector in Germany, €20bn in the UK, and almost €7.5bn in France.

At EQT, we are delivering residential-for-rent projects, including Saturn, in Greater London, and a major development in southern Stockholm. Located in Flemingsburg, a fast-growing hub for research and healthcare, this will provide 805 rental properties in an area of significant unmet demand, focused on researchers, young professionals and students. Both are examples of how private capital can support the development of high-quality, professionally managed homes for exactly those people who currently struggle to find suitable accommodation.

While much of the growing pool of capital is funding new developments such as these, investors are also enabling conversions of outdated buildings that no longer comply with environmental regulations, and in some cases, helping to repurpose offices or industrial properties as residential.

As investment flows, we increasingly expect professional operators to take the place of individual landlords who have dominated the private rental sector, who face pressure from higher interest rates,stricter regulations such as energy efficiency targets and cost pressures in order to provide a better service to their customers.

That underlines the need for dedicated expertise in a sector which is both growing in size and complexity. Managing large-scale refurbishments, such as upgrading energy sources, replacing windows, and adding insulation, all while tenants remain in place across hundreds of units, demands both capital and technical know-how. These projects often exceed the capacity of individual landlords and even many traditional core real estate investors.

Specialist investors and operators can ensure that existing buildings are effectively maintained and upgraded, and can also help offer a high level of service. That need not mean a concierge service or premium amenities, but rather proactive management of issues that tenants care about, from fixing broken appliances to resolving anti-social behavior issues.

A planning bottleneck

Equally, there are limits to what capital and expertise can achieve on their own. When it can take years for a developer to gain permission to build housing in a major European city, supply will continue to be sluggish, whatever investors do. Crumbling planning systems and an acute labor shortage in European cities led to a shortfall of 210,000 housing completions in Germany last year, 200,000 in France and 150,000 in the UK.

Investors are already coming to the table, recognising that the residential market is one where there is both a profound need for capital and an opportunity for steady, inflation-beating returns. The demand for more and better housing could not be clearer, and the investment is there to up the rate of supply. The question now is whether politicians and planning authorities are willing and able to help clear the way for the private sector to resolve problems in a market that has been broken for too long.

Peter Shacalis joined EQT Partners in March 2015. Prior to joining EQT Partners, Peter was an Associate in the Investment team at Wainbridge Limited, a private real estate investment, development and asset management company. He holds a BSc in Accounting and Finance from the London School of Economics and an MPhil in Real Estate Finance from the University of Cambridge (Distinction).

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofOpinion

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.