Why Pensions Could Be The Next Frontier for Private Assets

Regulatory initiatives are beginning to open up private equity to individual retirement savers, allowing them to diversify their retirement portfolios through access to private markets.

- While institutional pension funds have invested significant funds in private equity (PE), self-directed pensions often have little-to-no exposure.

Institutional pension funds, with their long-term investment horizons, have been a significant source of capital for private equity (PE), allocating sizable portions of their portfolios to private markets to diversify their assets and potentially boost returns. Personal pensions, meanwhile, have lagged behind.

The period of low interest rates from 2010 to 2022 saw more pension funds turning to PE investments in search of higher yields. As of 2023, 15 percent of the total assets of U.S. state pension funds were committed to PE, while in the UK, the state-backed pension program National Employment Savings Trust (Nest) aims to have 30 percent of its portfolio in private markets by 2030.

But while institutional funds are reaching their target allocations in PE, self-directed pensions still have little-to-no exposure to private markets. This is because strict financial regulations – and a conservative interpretation of fiduciary requirements – have historically limited individuals’ ability to access private markets.

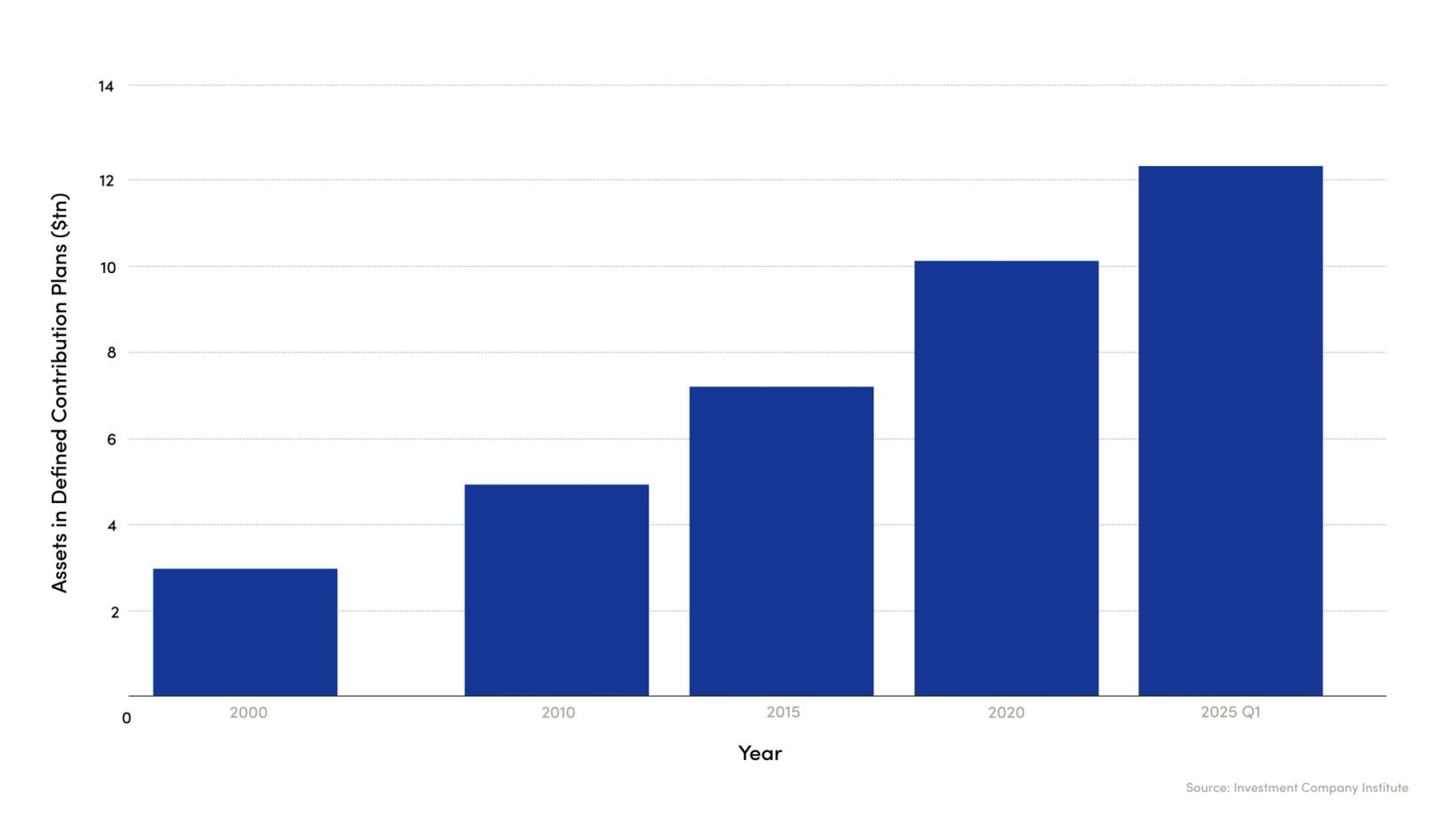

This might be an opportunity for both savers and PE firms. For individual investors, PE funds offer the chance to diversify their portfolio and potentially help enhance returns, one that can align well with retirement planning, given the longer investment horizon for private assets (typically over 10-year periods for PE funds). Although, of course, private markets are generally more complex than public markets and provide lower liquidity for investors. For PE firms, there is a sizable opportunity if they can tap into the capital within self-directed pensions, with $12tn invested in U.S. 401(k)s alone and the UK’s Self-Invested Personal Pensions market projected to grow to £750bn ($990bn) by 2030.

Self-directed pensions

In the last decade, the steady shift by employers from defined benefit (DB) – or final salary – pensions to defined contribution (DC) plans has continued. Sixty-nine percent of pensions in the U.S. are DC plans as of 2024, meaning savers’ retirement pots grow based on their contributions and investment returns, rather than a guaranteed annuity upon retirement.

The shift to DC plans means many savers take a greater interest in how their retirement savings are invested, with a growing interest in alternatives such as PE, as retail investors seek potentially stronger returns through access to earlier-stage, higher-growth companies. Sixty-seven percent of retail investors are now interested in including PE in their portfolio, according to a recent Apex Group survey, citing diversification as their primary driver.

This has led to the aforementioned growth in self-directed pensions – a type of retirement plan that allows individuals to have much more control over their investment choices, offering a broader range of investment options compared to traditional, institutionally managed pension plans. Self-directed pension funds in the U.S. can be employer-sponsored DC plans such as 401(k)s, or individually administered pensions such as Self-Directed Individual Retirement Accounts (SDIRAs) and Solo 401(k)s, for the self-employed. Similar products are available in Europe, for example, the UK’s Self-Invested Personal Pensions (SIPPs) or the European Union’s Pan-European Personal Pension Product (PEPP).

Regulatory barriers

However, despite having more freedom of choice, individuals with self-directed pensions still have limited access to private market assets, such as PE funds. A conservative interpretation of fiduciary duties under the Employee Retirement Income Security Act (ERISA) has historically limited the inclusion of PE investment opportunities in U.S. employer-sponsored 401(k) plans. Some plan sponsors, wary of potential litigation risks associated with complex and less liquid investments in private markets, also limited the opportunities to invest in PE.

The barriers are just as high for individuals self-administering their pensions, as the Securities and Exchange Commission (SEC) limits direct access to private funds to accredited investors (defined as those with a net worth of over $1m or annual income above $200k). In the UK, Financial Conduct Authority (FCA) rules similarly require individuals to self-certify as high-net-worth (£250k+ in assets) or sophisticated investors. Individual investors who don’t meet current thresholds can still gain private market exposure by investing their pensions in listed PE trusts, alternative regulated investment vehicles, or pooled access funds, which often have lower investment minimums. For example, investors can access global PE through trusts or via multi-asset funds that offer some exposure while maintaining greater liquidity and reduced entry barriers.

But direct exposure to PE often means high fees, long lock-up periods, and minimum investment thresholds – usually designed with institutional clients in mind, limiting accessibility.

New initiatives opening up private markets

It’s an accessibility challenge that regulators and governments are beginning to address. Steps are being taken to open up private markets to individuals, which could see self-directed pensions become a new frontier for private equity.

In Europe, a number of new investment initiatives have been designed with long-term investments for individuals in mind, including those investing via pensions. ELTIF 2.0, the recently updated regulation governing European long-term investment funds, for example, is intended to provide better private asset investment opportunities for retail investors. A recent rule change has broadened the number of eligible assets within these funds, increased the number of structuring options, and removed the €10k ($11k) minimum investment amount, although some national regulators still impose their own investment thresholds.

In the UK, the FCA has broadened Long Term Asset Funds (LTAFs) to allow retail investors to access a wide range of investment strategies, asset classes and liquidity terms, including PE, subject to exposure limits.

Meanwhile, in the U.S., there has been growing interest in non-publicly-traded Business Development Company (BDC) funds – pooled investment vehicles that invest in private companies.

The Department of Labor has allowed investments in PE through self-directed 401(k)s since 2021, but its rules mean that plan operators must ensure all opportunities to invest in private markets are compliant with the responsibilities outlined in the Employee Retirement Income Security Act (ERISA). For non-employee-sponsored pensions, the onus is on the individual investor to determine the appropriateness of specific private market investments.

In 2023, the U.S. Congress voted to pass the Equal Opportunity for All Investors Act (the bill is pending a vote in the Senate), which would allow investors to sit an exam to certify themselves as accredited and allow access to private markets. Trump’s return to the White House has further encouraged lobbyists in Washington to push for deregulation.

Although these structural reforms are necessary for change, PE firms will also need to take action if they want to appeal to individual savers with self-directed pensions.

Bridging the gap

Despite regulatory initiatives opening up investment opportunities for individuals, most PE products still aren’t designed with this category of investor in mind. To attract individual investors, PE firms could consider lowering minimum investment thresholds or offering options for liquidity, such as through secondary markets. Evergreen funds – open-ended private investment vehicles that allow for periodic redemptions and subscriptions – can also offer more flexibility and liquidity, potentially making them better suited for self-directed pensions. PE firms will also need to engage more proactively with investors to educate them on the dynamics of investing in private markets and offer greater transparency around fees and fund performance.

Historically, self-directed pensions’ limited access to private markets has restricted investors’ ability to diversify their pension portfolios and see returns from high-growth private companies. Changes in regulation will open up new opportunities for both investors and PE funds. Those firms that can lower barriers to entry, build trust and create transparent, well-structured products to meet the growing needs of self-directed pension holders will be well-placed to benefit.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofPrivate Equity

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.