EdgeConneX and the Race to Scale the Global Build-out of AI Factories

EQT Infrastructure backed EdgeConneX in 2020 to build data centers globally, meeting cloud and AI demand while delivering a more sustainable future of computing.

- EQT backed EdgeConneX in 2020 as cloud demand drove the first wave of hyperscale data center growth; AI has since accelerated it.

EQT followed EdgeConneX’s journey from its early years to its growth into a top data center industry player. Impressed by the company’s management team and its role in building global cloud infrastructure, EQT invested in EdgeConneX in 2020.

Since then, demand for digital infrastructure has only risen further, first through cloud adoption and now through AI workloads. Throughout this period, EdgeConneX has more than tripled its built data center capacity. Today, it has a global footprint of more than 80 data centers in operation or development in 50 markets across North America, Europe, APAC and South America.

There’s little sign of it slowing down. In 2026, the top five public cloud hyperscalers are forecasted by Bank of America to spend $670 billion on data centers as they rush to build out their AI infrastructure. Global data center capacity needs for AI and non-AI workloads are expected to triple by 2030, with AI capacity making up around 70 percent of total demand.

What they want, where they want, when they want

EdgeConneX started in 2009 with a simple idea: build data centers where customers actually need them. Initially, that meant small-scale edge data centers located closer to end users to reduce latency and network costs for content delivery and streaming platforms.

“We didn’t build it and tell our customers to come to us, as many colocation data centers typically do. It was very much a customer-centric, build-to-suit mindset of giving them what they wanted, where they wanted, when they wanted,” says Randy Brouckman, Co-founder and CEO of EdgeConneX.

By 2016, the public cloud hyperscalers exploded in growth, and EdgeConneX’s approach attracted their attention. They wanted partners who could build quickly, repeatedly, and at scale, and grow with them wherever they wanted to go.

“The form factor didn’t matter,” says Brouckman. “Two megawatts, 20 megawatts, 200 megawatts or far larger; we could do it and just say, ‘Hey, where do you want to go?’” It’s less of a vendor-customer relationship and more of a partnership mindset to collaborate on solving the digital infrastructure needs for the business.

Conviction through Covid

In early 2020, following several investments in fiber companies in the U.S. and Europe, EQT was looking at EdgeConneX to further expand its digital infrastructure footprint. “We knew there was this big trend of moving from private clouds to public clouds, and that the public cloud companies were scaling quickly and willing to outsource,” says Girish Sankar, Managing Director at EQT.

Then the world paused.

“In March of 2020, there was the big stop of Covid,” Sankar says. “A lot of private equity firms back then didn’t have conviction or pulled out.”

But it only built conviction for EQT. “Covid really doubled down our belief in the growth of data,” says Jan Vesely, Partner at EQT. “Everybody being on video, generating even more data and cloud needs; the trends were accelerated.”

EQT closed the deal in November that year, and growth quickly followed. “The first month after we closed, the company booked a very significant contract,” says Sankar. “The company grew 30 percent in size from that first large deal under our ownership. It was off to the races from there.”

Scaling a global platform

A key part of EdgeConneX’s expansion has been EQT’s ability to support the company – not just with capital, but with global reach and local connections.

Early on, EQT took an active M&A and joint venture approach, building the foundation blocks for EdgeConneX to grow around the world. This included a joint venture in India and buying GTN Data Center in Indonesia, alongside other transactions.

“The hyperscale customers wanted to grow with us, and they asked us to make it work in different parts of the world,” says Sankar. “‘Hey, can you come to Jakarta with me?’ ‘I need you in Kuala Lumpur.’ ‘We have needs in Mumbai, Osaka, Santiago…’”

To do that, EQT helped EdgeConneX scale the organization on the ground. “We’ve had to scale the team significantly, build out an Asia team, strengthen the European team, really build the local presence,” says Vesely. “You need to deal with local authorities, local permitting, local energy.”

That has translated into a delivery system engineered to scale: “We’re putting a lot of time into modularized delivery and how to set up the company to be able to deliver gigawatt-scale projects in each geography,” says Vesely. That means finding and working with the right partners across engineering, manufacturing, production, construction, and operations.

And as the builds get bigger and more complex, the partnership gets closer. “Every decision is a huge CapEx project,” says Sankar. “When we plan to build a gigawatt campus, that could be a $10bn CapEx commitment or more. Each large build-out is like a deal in itself. So we need to be super close to the company.”

“There aren’t many data center companies that have the financial backing to be able to build one of these, much less multiple AI facilities,” says Brouckman. “Having EQT’s backing is absolutely massive because it gives both our customers and us the confidence that we’ll be able to build out and have the long-term commitment and resources to do so.”

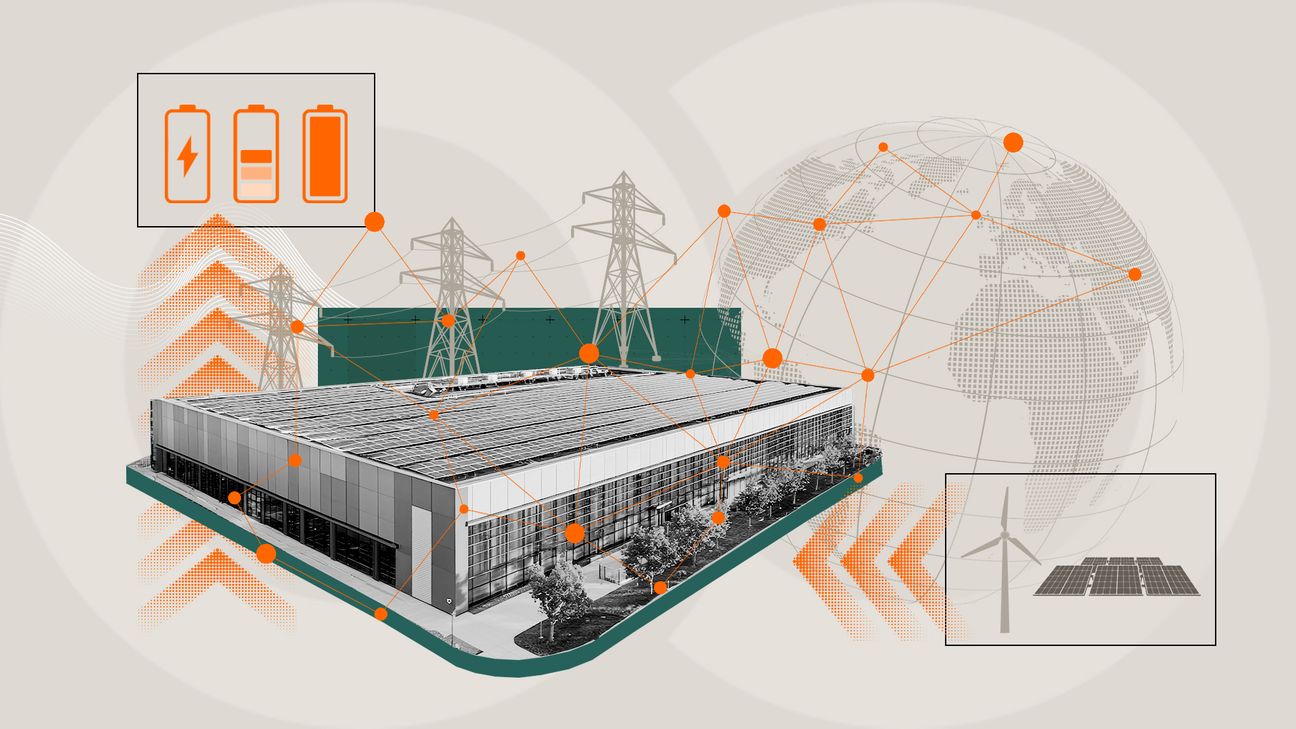

Powering AI workloads

Cloud drove the first wave of hyperscale buildout, but AI has changed the scale and technical requirements of what comes next.

“The annual growth rate for the entire data center marketplace just a few years ago was five gigawatts. Texas alone in 2027 will be five gigawatts,” says Brouckman.

This demand is a boon for EdgeConneX, and a complication.

The power required for each data center rack used to be in the single digits of kilowatts. But new generations of chips are increasing the computing – and thus power – density of racks. In the next few years, a single server rack could require up to 1,000 kilowatts, or one megawatt. When EdgeConneX started, an entire data center required just two to four megawatts.

“We have to completely redesign the data center to be able to cool it, to power it at these tremendous densities,” Brouckman says.

The energy gap

So, power is now the main bottleneck. Brouckman puts it bluntly: “Is there enough power in the U.S. grid to support this? There is not.”

And even if there is power, “there’s a lack of investment in transmission lines to take the power from the grid to where you have the data center,” says Brouckman. “Can you get that power to where you need to be?”

Grid operators are increasingly demanding data center operators sign upfront “take-or-pay” contracts and make commitments of up to 20 years. Data center operators are also under pressure to ensure that the power demands of new campuses don’t overwhelm the local grid. In areas near data centers, wholesale electricity costs are already as much as 267 percent more than they were five years ago, and that’s being passed on to consumers.

“This is where EQT comes in with its power portfolio of companies like Zelestra, Cypress, Scaled, OX2,” says Brouckman. EQT has provided partnership opportunities with its renewable energy portfolio companies, in a mission to help EdgeConneX become a data center provider powered by 100 percent renewable energy by 2030.

Where possible, EdgeConneX and EQT are co-locating data centers with renewable power generation, reducing reliance on the grid and, in turn, making the grid more resilient by building local sources of supply.

Just the beginning

EdgeConneX means to go on as it began. Building what, where, and when customers need capacity. The difference now is the scale and the increasingly integrated offer that brings together compute, power, and connectivity. With EQT, the company is solving every customer challenge needed to build out these AI factories around the world.

“We’re still in the early stages of building out the infrastructure for AI,” says Vesely. “EdgeConneX is already a global platform, and we want to build on that. Our customers are global, and we want to grow with them across all regions and really focus on providing integrated solutions between energy and data centers. I think that’s truly what’s going to be needed to support the growth.”

In the next few years, Sankar expects the pace to remain high.

“I could see the company multiplying in size, which is tremendous because the company’s already progressed a lot in the last five years of our investment,” he says. “But we believe that the tremendous growth is only going to continue to accelerate.”

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

On the topic ofCase Studies

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.