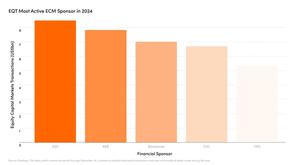

EQT Led Equity Capital Markets Board for Second Year Running

EQT was the most active private markets firm in equity capital markets in 2025. The ranking capped a record year for deal exits at EQT.

- With $15.2bn in ECM transactions in 2025, EQT ranked first among private equity firms.

EQT was the most active private markets firm in equity capital markets (ECM) transactions for the second year running, with share sales helping channel money back to investors.

According to data from Goldman Sachs and Dealogic, ECM deals by EQT portfolio companies totalled $15.2bn in 2025. The value of EQT-related deals was almost 75 percent more than 2024 when EQT also topped the same leaderboard with $8.6bn in transactions.

ECM deals, which raise capital by selling shares through an initial public offering or secondary sales to institutional and other investors, are an important exit route for private equity funds to reduce their stakes in portfolio companies and return money to investors.

“EQT has been able to monetize its investments in the public market fairly rapidly due to our philosophy of trying to make sure that investors earn money on EQT’s selldowns and always leaving some money on the table,” said Magnus Tornling, Global Head of Equity Capital Markets at EQT.

EQT most active in ECM deals for 2025

Equity selldowns executed in 2025 included stake sales in healthcare revenue management firm Waystar and skin care group Galderma. ECM deals are important because the private markets industry overall has struggled in recent years to exit investments at pace, resulting in a lack of liquidity for investors. Data from Bain & Co. showed the rate of distributed capital across the private equity industry had fallen well below the medium-term average.

ECM transactions formed part of EQT’s overall deal flow. In aggregate, EQT delivered its best exit year to date, with more than €19bn in gross realizations for the funds, and €14bn of realizations for co-investors. In 2025, EQT executed more than 30 exits across funds in Asia, Europe, and North America.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]

MoreInsights

Exclusive News and Insights Every Week

Sign up to subscribe to the EQT newsletter.