Cultivating the Future: Ideas to Grow Wealth Beyond the Third Generation

What do farming and investing have in common? More than you may think, says Marah Marshall, EQT’s Head of Private Wealth Global Partnerships & Strategy.

We’re just coming out of the holiday season, when – for better or worse – we spend lots of quality time with close friends and family. It’s also a season when we can pause to think about what’s important, whether health or business or planning for the future.

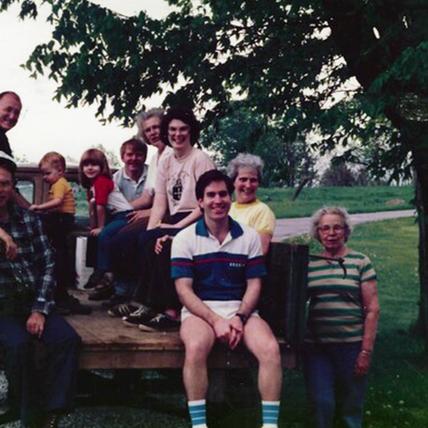

I recently spent my Thanksgiving (for the better!) back on my family farm in southern Indiana, helping my parents host 40 aunts, uncles, cousins, nieces and nephews. It’s a gathering we do every two years, calling everyone home for a Thanksgiving dinner that this year spanned the fifth, sixth and seventh generations of our family and took over the dining room and great room of the farmhouse.

Conversation with the fifth generation (my parents, their siblings and cousins, aged 64 to 86) focused on the near term. What was the harvest like this year? What are we prepping and planting for next season? Will we go for corn or soybeans?

As I looked at my generation, who are now “the parents,” ranging from age 30 to 44, I realized we had 17 kids between us. This seventh generation runs from 19 to a one-month-old. My cousins and I asked, how do we develop or keep the interest in our family land with them? What do we plant now in their minds, their experiences and in the actual soil so they and their children have a place to gather and grow in years to come?

We grow three things on our farm: Corn, soybeans and timber, which are perfect juxtapositions. Corn and soybeans equal the near term. You plant them, they grow for three to six months and you harvest. Timber equals the long term. You plant trees now to harvest in 15 to 20 years. These near-term and long-term views are critically important to the farmer thinking about how to be a good steward of their land and to a company founder or investor thinking about how to be a good steward of their generational wealth.

Volatility in markets and families

In farming, you can’t predict the weather. In investing, you can’t predict the impacts of administration changes, government regulations, onshoring, offshoring, tariffs or geopolitical conflicts. Both professions have volatility in both the near- and long-term.

Family dynamics have their own volatility, too. The adage about creating generational wealth goes: The first generation creates the wealth, the second generation grows the wealth, and the third generation “loses” the wealth.

Successfully passing a business down to a sixth or seventh generation is, sadly, rarer than you might think. In my experience in the private wealth sector, even a significant business – generating a significant fortune – can unravel within three generations.

For 2025, there seems to be one thing all industry experts agree on: Volatility is coming, and maybe it’s already here. When it seems like waves of volatility are heading my way, I prefer to focus on what can be cultivated right in front of me that can lead to a stronger preparedness for current or future generations. Here are three areas my grandparents taught us to focus on as a family for our farm – ideas that resonate with how EQT invests in founder-run businesses and assets.

Value creation

First, there’s the financial value of an asset or company. There is how much something costs and whether or not you can afford it. And then there is what you value: What’s important to you. You may be able to afford a new item but it may not hold a lot of value for you. You can create value in a company by doing some fancy math or you can create value by adding new products, refining a service offering or growing your client base.

Companies – good ones – will have values and mission statements that drive their employees and leadership decisions. Families and family businesses shouldn’t be all that different.

On my family farm, it is our mission to responsibly maintain and develop our land for future generations. We value education, stewardship and dedicated time together on the farm to maintain our family history and connectivity.

Similarly, at EQT our mission is to create value for our investors and the next generation of ownership in the companies and assets we invest in.

Governance and education

You can’t run a business or a family without a bit of governance – and you need to educate the up and coming talent so they can be ready to lead.

Governance for my family came in the form of my Granmary. She was the matriarch and she ran things on the farm and in the family, setting the cadence of family gatherings, what was to be accomplished at those gatherings and who was responsible for what. She and her siblings were also the educators. They taught all of us how to use a tractor, plant corn, and how to weed a garden. They set the foundation for me and my cousins as the next leaders of the family by demonstrating the principles of sound management day after day. After all, education is most effective when you can start early and repeat the lessons often.

Companies and investment strategies can fall apart quickly when they lack or ignore governance models and when they don’t educate their stakeholders on what’s important. EQT seeks to deploy strong governance models and educational frameworks, both for itself and for its portfolio companies.

Stewardship and purpose

My dad has often said to me “Marah, I may live on and work this land, but I don’t view myself or even your mom as owning it. I’m just a steward of it for you and your brother.” I was well into my 20s when I learned that my Granmary was and had been for some time the majority owner of our farm corporation. She, over time, had bought out all her siblings. This impressed me both financially and culturally. The way she talked about and managed the farm was that it belonged to all of us and those that came after us. It wasn’t “hers”. We each had the responsibility and purpose to come home to help grow and keep it going for future generations. She and her siblings had built stewardship and purpose into all of us without us knowing it.

We have a saying at EQT, “Doing good is good business”. Along with our mission to generate superior returns for our investors, we have a purpose to future-proof companies and make a positive impact. Giving purpose and focusing on the stewardship of assets for the next generation of owners can alleviate the awkwardness and overwhelming nature of inheriting it when the time comes and help ensure it lasts beyond that third generation. It’s not “theirs” or “ours”, we are all simply the stewards.

2025 is going to have volatility, but that volatility doesn't have to be scary or overwhelming if you're prepared. This holiday season, consider setting aside time to define your values, mission, stewardship and purpose and throw in a good dose of governance. Then when the time is right, start to educate your next generation. Growing past the third generation is possible if you cultivate them early and often.

The views expressed in this publication are the personal views of Marah Marshall and do not necessarily reflect the views of EQT AB or any of its affiliates.

Marah Marshall is Head of the Private Wealth Global Partnerships & Strategy team at EQT and based in New York.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]