The Rise of Industrial Real Estate

Cultural shifts such as online shopping and working from home have seen demand - and rental rates - for industrial real estate soar as the sector becomes a more appealing prospect.

- The popularity of e-commerce has affected the traditional retail landscape

America’s once-bustling malls are turning into empty relics, inspiring YouTube channels and fan sites dedicated to exploring abandoned shopping centers. Meanwhile, a nostalgic media mourns the decline of mall mainstays like GameStop, Old Navy, and Victoria’s Secret.

The undeniable popularity of e-commerce has upended the traditional retail landscape. According to U.S. Census Bureau data, e-commerce accounted for 16 percent of U.S. retail sales in the third quarter of 2024. That’s up from 6 percent a decade ago and just 2 percent 20 years earlier.

The fast-growing consumer demand for online shopping forced a rapid evolution of supply chains and logistics practices to handle the growing volume of direct-to-consumer sales. This shift fundamentally changed how private and institutional capital is deployed in the real estate market in a relatively short period.

“As recently as 10 years ago, industrial real estate was seen as a fairly unremarkable asset class,” says Ali Houshmand, Global Head of Non-Traded REITs at EQT Real Estate. “However, the rise of e-commerce significantly increased its appeal.”

Demand for industrial real estate — specifically, warehouses and other logistics hubs, truck terminals, outdoor storage for shipping containers, and anything else critical to e-commerce supply chains — has soared, pushing up rental rates and catching the eyes of private money managers. As more private capital flowed into industrial, institutional investors like pension funds and sovereign wealth funds quickly followed suit.

Meanwhile, even as consumers spent more overall, demand for retail real estate fell. Research by CoStar indicates that per capita retail space in the U.S. dropped from 56.5 square feet in early 2009 to 54.3 square feet late last year. Lower demand meant lower rents, prompting some investors to reconsider their exposure and reallocate their capital into industrial real estate.

“As hybrid work models evolve, the US office market will continue to face headwinds compared to peak usage in previous years which further limits liquidity in the sector for investors in the space.”

Another factor boosting industrial real estate’s popularity among private and institutional investors is the decline of the office. As with the e-commerce boom, this trend was underpinned by advances in technology.

The Covid-19 pandemic proved that remote work was possible thanks to modern productivity software like video conferencing and cloud-based messaging. “It accelerated uncertainty with respect to office as an attractive core real estate holding for institutional investors, a trend we were seeing before the pandemic,” Houshmand says. “As hybrid work models evolve, the U.S. office market will continue to face headwinds compared to peak usage in previous years which further limits liquidity in the sector for investors in the space.”

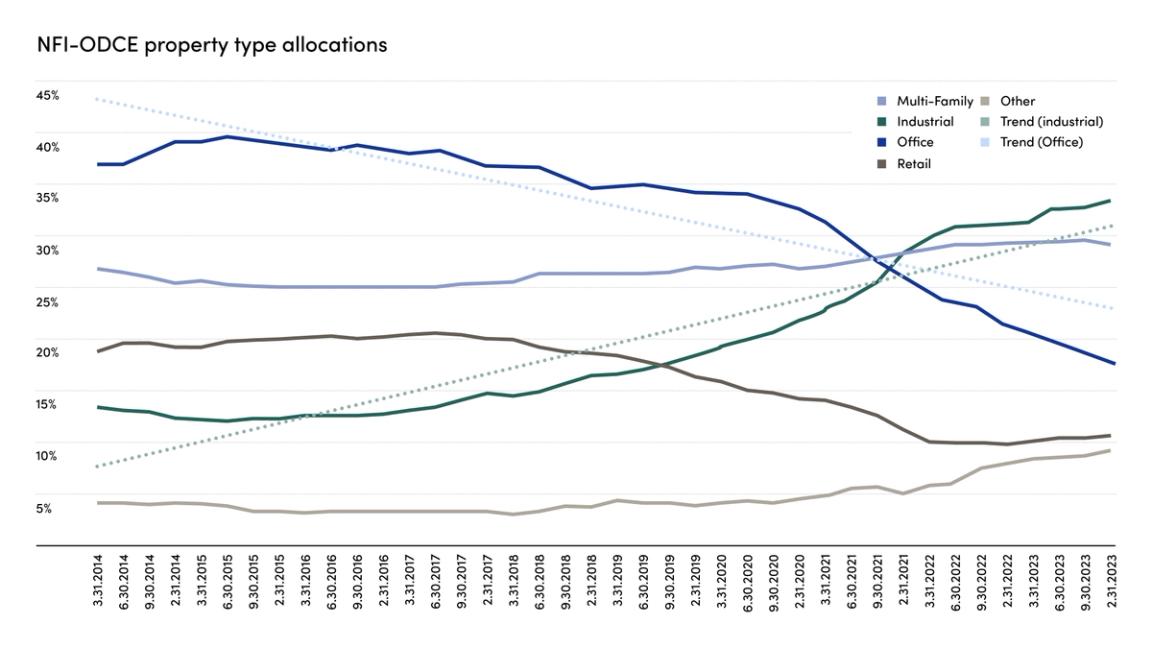

The effect of these trends on the relative appetite for office, retail, and industrial real estate investment can be seen by breaking down the NFI-ODCE index, which tracks the performance of about 25 private real estate funds. In 2014, the constituents of the index had about 20 percent of their money in retail, 14 percent in industrial, and 37 percent in office. As of September 2024, the allocations shifted to 11 percent in retail, 34 percent in industrial, and 17 percent in office.

The catalyst? Rising industrial rents. Savills reports that the U.S. industrial property rental rate jumped from just over $4 per square foot in 2014 to nearly $10 per square foot at the start of this year.

Yet, retail investors — generally defined as individuals with liquid assets of $1m or less — have mostly missed out on these gains enjoyed by institutional investors. An estimated 90 percent of the $16tn U.S. commercial real estate market is privately owned, typically by funds. Access to these funds often requires multimillion-dollar minimum investments, among other restrictions, that all but exclude retail investors.

Some investment vehicles are now trying to lower these barriers to entry by reducing minimum investment thresholds and simultaneously navigating strict regulatory requirements designed to protect individual investors. Meanwhile, a growing number of digital platforms are offering retail investors access to private funds by pooling their investments so they exceed minimum thresholds.

“It is encouraging to see retail investors gain more access to U.S. commercial real estate, especially as strong tailwinds from increasing manufacturing demand and continued e-commerce penetration position the industrial real estate sector for sustained growth,” Houshmand says.

As America’s real estate investment landscape evolves, the shift from retail and office spaces to industrial properties highlights a broader transformation redefining investment opportunities and who gets to partake in them.

ThinQ by EQT: A publication where private markets meet open minds. Join the conversation – [email protected]