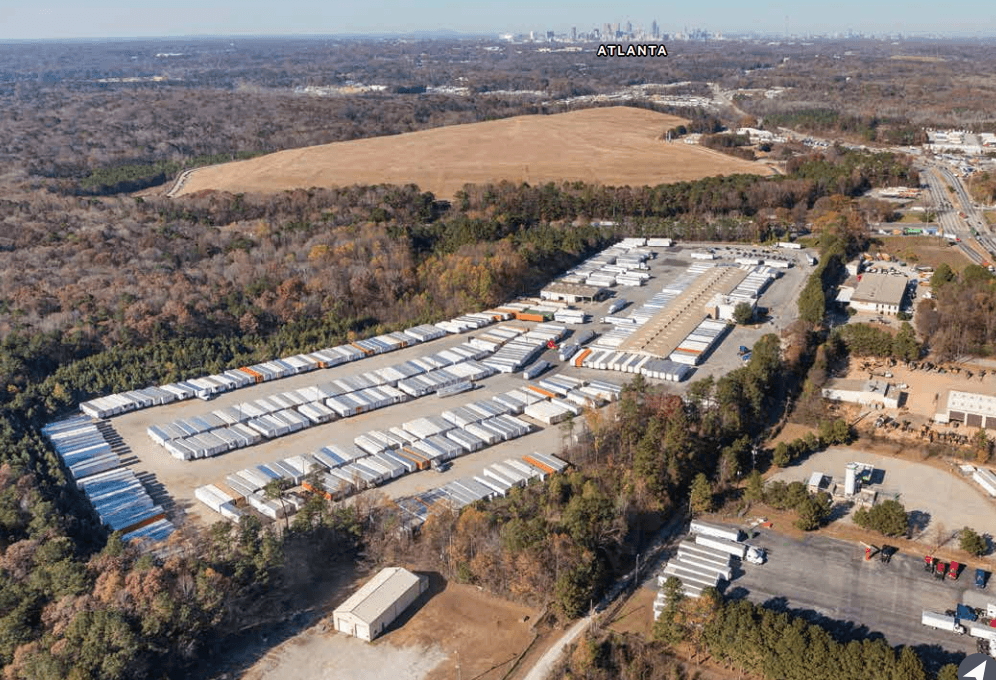

EQT Real Estate completes sale of national truck terminal portfolio

- Portfolio includes seven logistics assets totaling 475 dock-high and drive-in doors, 89 usable acres and more than 312,000 square feet

- Properties span six U.S. states, concentrated in Phoenix, Atlanta, Southern California and Texas

- Sale reflects growing institutional demand for mission-critical freight infrastructure

EQT is pleased to announce that the EQT Real Estate Industrial Value Fund V (“EQT Real Estate”) has completed the sale of a seven-asset truck terminal portfolio across the U.S. The portfolio includes high-flow-through industrial facilities located across major freight corridors, supporting the growing need for efficient goods movement and regional distribution.

Assembled through a series of strategic acquisitions between 2021 and 2022, the portfolio comprises more than 312,000 square feet, 475 dock-high and drive-in doors, and spans 89 acres across Phoenix, Atlanta, Southern California’s Inland Empire, Texas and Wichita. The sites are fully paved, fenced, and located within three miles of major interstates, offering last-mile access to densely populated markets.

EQT implemented robust targeted leasing and site improvements to institutionalize the portfolio and bring it to stabilization. The properties are now leased to a diversified mix of national and regional logistics users.

The transaction is part of EQT Real Estate’s broader disposition strategy as it selectively crystallizes marquee investments across its industrial platform. Backed by a strong, world-class management team and deep local operating partners, EQT remains well-positioned to execute efficiently in today’s market environment.

Matthew Brodnik, Chief Investment Officer at EQT Real Estate, said: “This sale reflects the depth of buyer interest for functional, well-located logistics assets. Our team did a tremendous job executing on the value creation plan for these assets, upgrading each property, enhancing site functionality, and securing significant moderate-to-long-term leasing commitments from blue-chip tenants. Demand for freight and logistics infrastructure remains strong, and we look forward to continuing to unlock value across our portfolio as market opportunities evolve.”

EQT Real Estate was advised by Brian Fiumara and Zach Graham of CBRE National Partners.

Contact

EQT Press Office, [email protected]

Downloads

About EQT Real Estate

EQT is a purpose-driven global investment organization with EUR 266 billion in total assets under management (EUR 141 billion in fee-generating assets under management) as of 30 June 2025, divided into two business segments: Private Capital and Real Assets. EQT supports its global portfolio companies and assets in achieving sustainable growth, operational excellence, and market leadership. Within EQT’s Real Assets segment, EQT Real Estate acquires, develops, leases, and manages logistics and residential properties in the Americas, Europe, and Asia. EQT Real Estate owns and operates over 2,000 properties and 400 million square feet, with over 440 experienced professionals across 50 locations globally.

More info: www.eqtgroup.com

Follow EQT Real Estate on LinkedIn

Exclusive News and Insights Every Week

Add your email address below to sign up for our EQT newsletters.