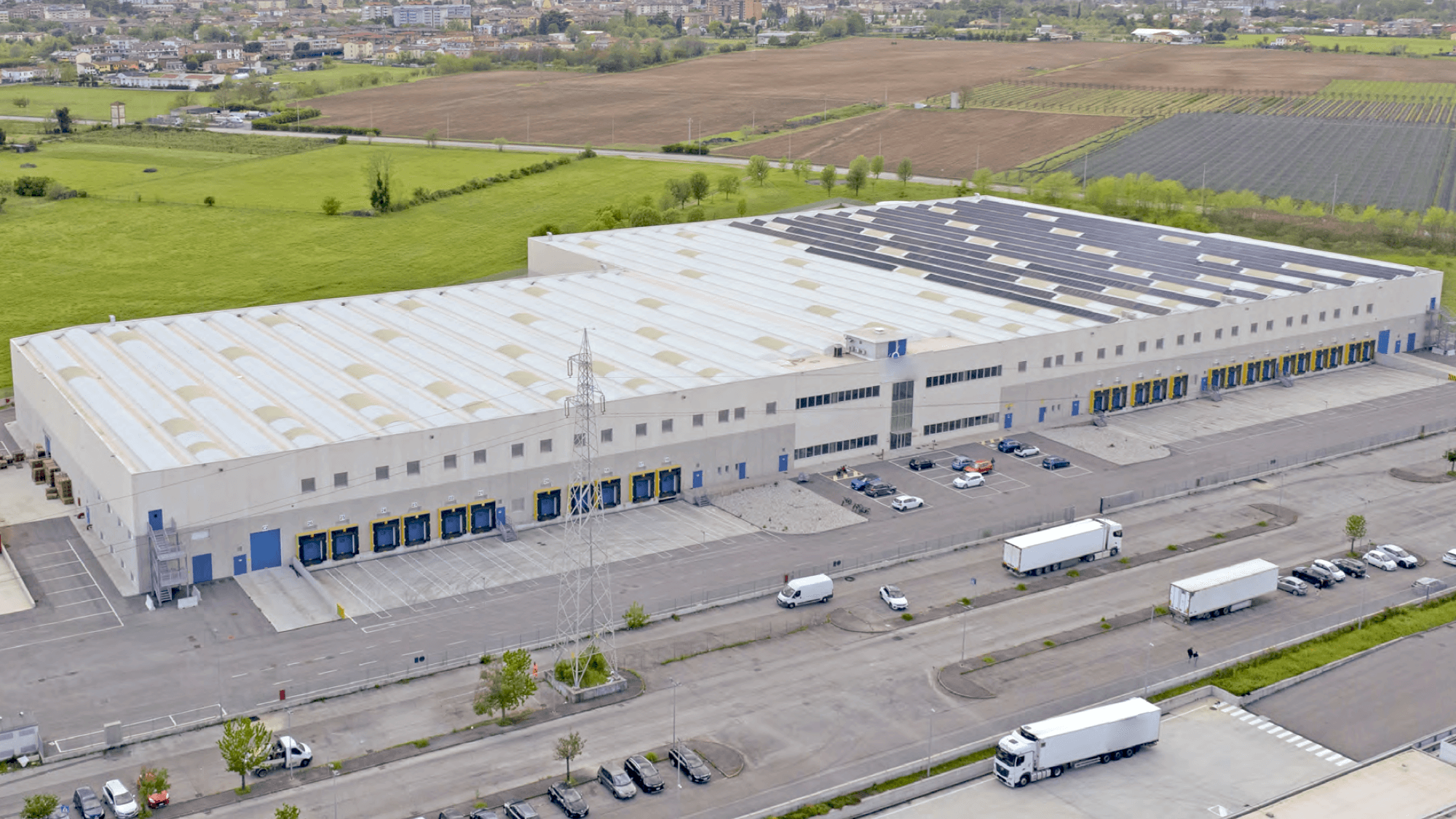

EQT Real Estate acquires a portfolio of four high-quality logistics assets in Northern Italy

- EQT Real Estate has acquired a logistics portfolio totalling approximately 107,000 square metres, located in key Italian markets including Milan, Bologna and Verona

- Assets offer long-term income with significant value creation opportunities, supported by Grade A technical specifications and strong sustainability credentials

- Transaction strengthens EQT Real Estate’s exposure to the Italian logistics market, one of Europe’s most attractive and supply-constrained markets

EQT is pleased to announce that the EQT Exeter Europe Logistics Core-Plus Fund II (“EQT Real Estate”), has acquired a high-quality logistics portfolio comprising four assets (the “Properties”) located in the key Northern Italian submarkets of Milan, Bologna and Verona. The assets will be acquired by Kryalos SGR S.p.A on behalf of EQT Real Estate.

The Properties, totalling approximately 107,712 sqm and which are fully let to a strong, diversified tenant base, comprise modern, institutional-quality logistics assets. The portfolio benefits from excellent connectivity to core distribution locations via key motorways, including the A1, A4 and A22, providing access to major population centres and a catchment area of more than 20 million inhabitants.

The transaction further enhances EQT Real Estate’s exposure to the Italian logistics market, which continues to benefit from attractive structural trends and favorable supply-demand dynamics shaping market conditions. The acquisition reflects EQT Real Estate’s confidence in the Italian logistics sector’s long-term prospects and its ability to generate long-term value through active asset management and sustainability-led initiatives.

Greg Vinson, Partner at EQT Real Estate, said: “The transaction fits perfectly within our Core Plus strategy’s objective to acquire highly reversionary, modern logistics assets that offer long-term lease stability, stable income and significant value creation opportunities. As the Italian logistics market remains resilient, driven by demand for Grade A and sustainability-compliant warehouses, we are thrilled to be expanding our exposure and further drive value in the Properties that are well-connected to some of Italy’s fastest-growing cities”.

EQT Real Estate was advised by Legance (tax and legal), Howden (insurance), Arcadis (technical).

Contact

EQT Press Office, [email protected]

Downloads

About EQT Real Estate

EQT is a purpose-driven global investment organization with EUR 267 billion in total assets under management (EUR 139 billion in fee-generating assets under management) as of 30 September 2025, divided into two business segments: Private Capital and Real Assets. EQT supports its global portfolio companies and assets in achieving sustainable growth, operational excellence, and market leadership. Within EQT’s Real Assets segment, EQT Real Estate acquires, develops, leases, and manages logistics and residential properties in the Americas, Europe, and Asia. EQT Real Estate manages about $58 billion in GAV, owns and operates over 2,000 properties and 400 million square feet, with over 400 experienced professionals across 50 locations globally.

More info: www.eqtgroup.com

Follow EQT Real Estate on LinkedIn

About Kryalos

With €13.8 billion of AuM and a team of 125 professionals, Kryalos is one of the most active players in the Italian real estate market. The company offers transaction management, real estate and credit fund management, development and advisory services and is a partner of Italian and international leaders. Further information on www.kryalossgr.com

Exclusive News and Insights Every Week

Add your email address below to sign up for our EQT newsletters.