EQT Private Equity to acquire PRO Unlimited, a leader in contingent workforce management

EQT Private Equity to acquire PRO Unlimited, a leading provider of integrated contingent workforce management solutions through its holistic platform which includes managed service program, vendor management software, direct sourcing and data and analytics capabilities.

PRO Unlimited enables companies to effectively tap into the growing market for high-skilled contingent labor while providing workers more opportunities for flexible employment.

EQT will support PRO Unlimited’s continued growth and ongoing development of new products to further expand its integrated platform offering.

EQT is pleased to announce that the EQT IX fund (“EQT Private Equity”) has agreed to acquire PRO Unlimited Global Solutions Inc. (“PRO Unlimited” or the “Company”), a leader in contingent workforce management solutions, from funds managed by Harvest Partners, LP and its affiliates (“Harvest Partners”) and Investcorp. Following the close of the transaction, EQT Private Equity will be the majority shareholder and the existing PRO Unlimited management team will continue to operate the business.

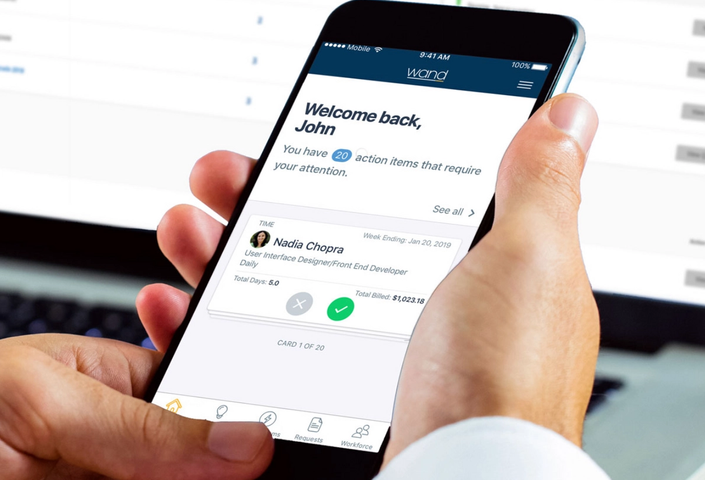

PRO Unlimited was established in 1991 to assist large companies in managing their contingent workforce to better attract specialist talent seeking a more flexible work solution. Today, the Company’s integrated solutions have grown to incorporate a managed service program, vendor management software, direct sourcing and data and analytics capabilities. The platform handles the significant complexities of running an effective contingent workforce program on behalf of enterprise clients, fulfilling a multitude of tasks including discovering a client’s staffing needs, finding and evaluating candidates, hiring, onboarding, providing payroll and offboarding the contingent workers. PRO Unlimited is differentiated through its focus on high-skilled labor, its staffing agency-neutral approach, and its unique integrated solutions of services, software, and proprietary market data. The Company is headquartered in San Francisco with global capabilities and has approximately 1,400 total employees.

EQT will leverage its extensive experience partnering with technology-enabled services businesses, in-house digital expertise and network of global EQT advisors to support PRO Unlimited in its next phase of development as the Company continues to invest in technology and innovation to expand its integrated platform capabilities.

Kasper Knokgaard, Partner within EQT Private Equity’s Advisory Team, said, “EQT is excited to invest in PRO Unlimited and partner with CEO Kevin Akeroyd and the full PRO Unlimited team as the Company embarks on the next phase of continued growth. PRO Unlimited has been at the forefront of developing a fulsome suite of integrated solutions for companies to manage their contingent workforce through a combination of services, software, and data. We look forward to supporting the continued expansion of the platform to enable more flexible work solutions for the evolving contingent industry.”

Andrew Schoenthal, Partner at Harvest Partners, said, “Through multi-year investments in people, technology and data, PRO Unlimited has developed among the most comprehensive contingent workforce platforms for large and global companies. We are excited to watch Kevin and his team build upon the enormous success that the Company has achieved to date and continue to bring new innovations to the market.” Harvest’s PRO Unlimited investment team is led by Ira Kleinman, Andrew Schoenthal and David Schwartz.

Kevin Akeroyd, CEO of PRO Unlimited, said, “We are proud of what PRO Unlimited has achieved in recent years in collaboration with Harvest Partners and Investcorp. The contingent labor industry is experiencing strong growth, fueled by workers desire for increased autonomy and flexibility. We are delighted to provide the solutions to enable enterprises and the contingent workforce to meet their needs. We look forward to partnering with EQT and leveraging their industry expertise, digital capabilities, and network of advisors.”

The transaction is subject to customary conditions and approvals. It is expected to close in the second half of 2021.

EQT Private Equity was advised by BofA Securities, Sidley Austin LLP, McKinsey & Company and Alvarez & Marsal.

PRO Unlimited, Harvest Partners and Investcorp were advised by William Blair and White & Case.

With this transaction, EQT IX is expected to be 50-55 percent invested (including closed and/or signed investments, announced public offers, if applicable, and less any expected syndication), and subject to customary regulatory approvals.

Contact

US inquiries:

Stephanie Greengarten,

+1 646 687 6810,

stephanie.greengarten@eqtpartners.com

International inquiries:

EQT Press Office,

press@eqtpartners.com

+46 8 506 55 334