EQT Companies Top the IPO Return Tables for 2024

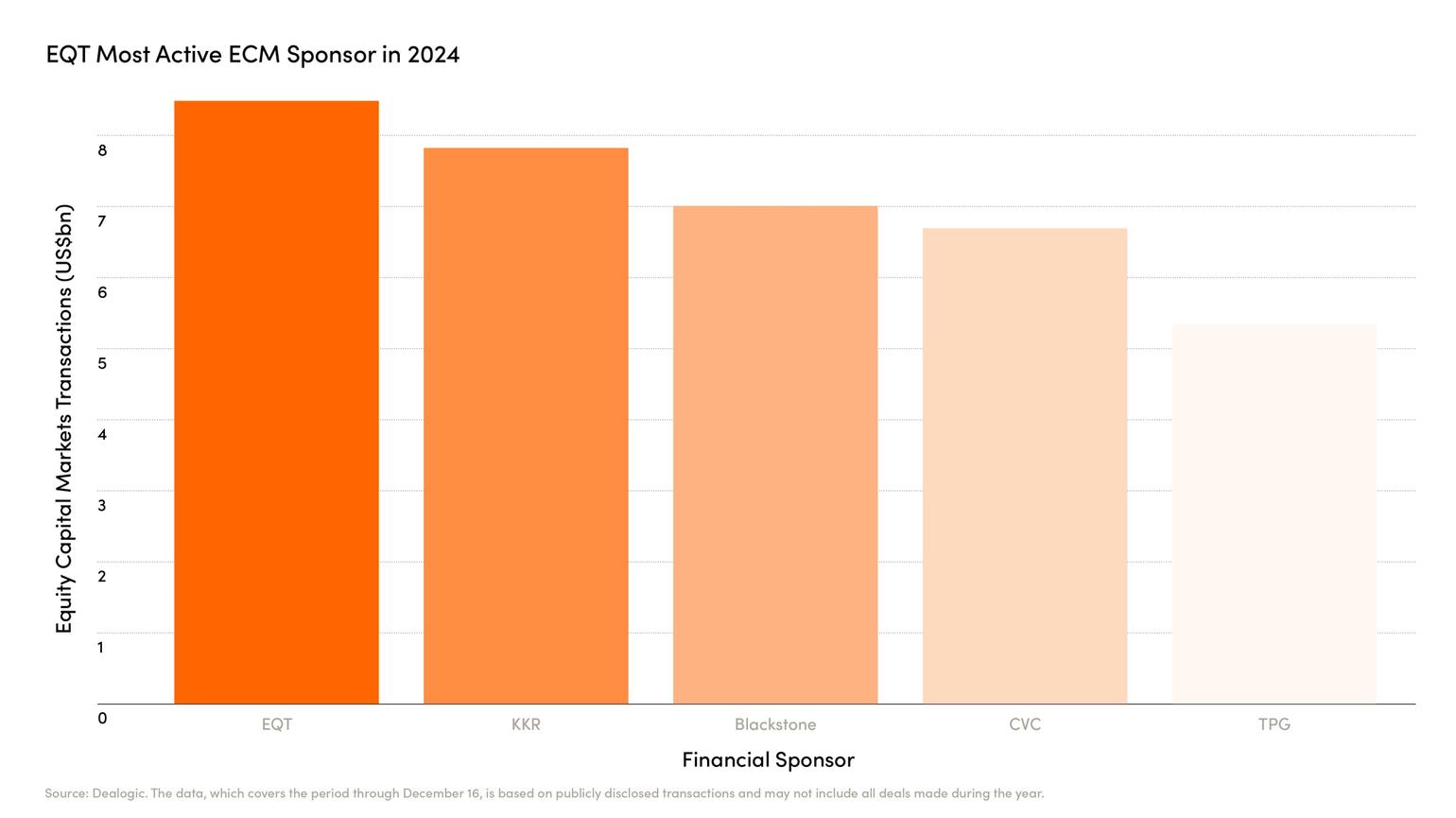

EQT ranked first in the equity capital market transaction rankings for 2024, reflecting strong performance by its portfolio businesses.

According to data compiled by Dealogic and Goldman Sachs Investment Banking, EQT-owned companies were involved in equity capital market (ECM) deals worth a combined $8.6bn, the largest cohort globally by total volume of deals of any private equity manager portfolio in 2024.

ECM deals refer to raising capital by selling shares through an initial public offering (IPO) or secondary sales to institutional and other investors.

ECM transactions by EQT-backed companies in 2024 included dermatology specialist Galderma, energy service provider Kodiak, and healthcare service providers Sagility and Waystar. These transactions come at a time when many private equity firms have struggled to arrange exits from portfolio companies.

“We believe that it is vital that a newly listed company either meets or exceeds market expectations when it comes to financial performance, so we are spending considerable time ensuring that our portfolio companies are prepared.”

This matters because the large institutional investors that dominate the equities trading market are increasingly evaluating the track record of PE-backed companies once they list on exchanges, said Magnus Tornling, Global Head of Equity Capital Markets at EQT.

“Properly future-proofing EQT portfolio companies to set them up for success after our exit has been critical for building our track record,” Tornling said. “We believe that it is vital that a newly listed company either meets or exceeds market expectations when it comes to financial performance, so we are spending considerable time ensuring that our portfolio companies are prepared.”

Private equity firms need viable exit strategies in order to return money to investors. It is therefore important that PE firms have a strong reputation in the market for selling high quality portfolio companies. Private equity firms that fail to do this will find that their portfolio companies struggle to achieve strong valuations at IPO.

ThinQ is the must-bookmark publication for the thinking investor.